Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159 Exercise 45

Financing business expansion

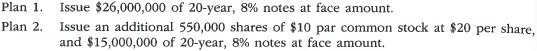

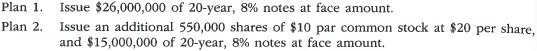

You hold a 25% common stock interest in YouOwnIt, a family-owned construction equipment company. Your sister, who is the manager, has proposed an expansion of plant facilities at an expected cost of $26,000,000. Two alternative plans have been suggested as methods of financing the expansion. Each plan is briefly described as follows:

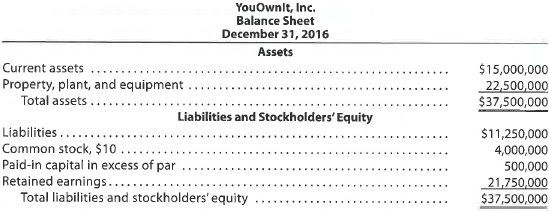

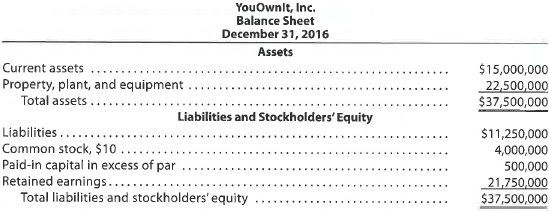

The balance sheet as of the end of the previous fiscal year is as follows:

Net income has remained relatively constant over the past several years. The expansion program is expected to increase yearly income before bond interest and income tax from $2,667,000 in the previous year to $5,000,000 for this year. Your sister has asked you, as the company treasurer, to prepare an analysis of each financing plan.

1. Prepare a table indicating the expected earnings per share on the common stock under each plan. Assume an income tax rate of 40%. Round to the nearest cent.

2. a. Discuss the factors that should be considered in evaluating the two plans.

b. Which plan offers the greater benefit to the present stockholders Give reasons for your opinion.

You hold a 25% common stock interest in YouOwnIt, a family-owned construction equipment company. Your sister, who is the manager, has proposed an expansion of plant facilities at an expected cost of $26,000,000. Two alternative plans have been suggested as methods of financing the expansion. Each plan is briefly described as follows:

The balance sheet as of the end of the previous fiscal year is as follows:

Net income has remained relatively constant over the past several years. The expansion program is expected to increase yearly income before bond interest and income tax from $2,667,000 in the previous year to $5,000,000 for this year. Your sister has asked you, as the company treasurer, to prepare an analysis of each financing plan.

1. Prepare a table indicating the expected earnings per share on the common stock under each plan. Assume an income tax rate of 40%. Round to the nearest cent.

2. a. Discuss the factors that should be considered in evaluating the two plans.

b. Which plan offers the greater benefit to the present stockholders Give reasons for your opinion.

Explanation

1. Net income: whether the expansion gen...

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255