Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159 Exercise 60

Comprehensive income

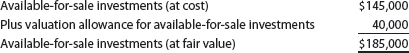

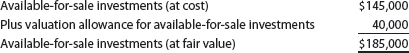

On December 31, Year 1, Valur Co. had the following available-for-sale investment disclosure within the Current Assets section of the balance sheet:

There were no purchases or sales of available-for-sale investments during Year 2. On December 31, Year 2, the fair value of the available-for-sale investment portfolio was $200,000. The net income of Valur Co. was $210,000 for Year 2.

Compute the comprehensive income for Valur Co. for the year ended December 31, Year 2.

On December 31, Year 1, Valur Co. had the following available-for-sale investment disclosure within the Current Assets section of the balance sheet:

There were no purchases or sales of available-for-sale investments during Year 2. On December 31, Year 2, the fair value of the available-for-sale investment portfolio was $200,000. The net income of Valur Co. was $210,000 for Year 2.

Compute the comprehensive income for Valur Co. for the year ended December 31, Year 2.

Explanation

Computation of Comprehensive Income:

St...

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255