Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159 Exercise 47

Six measures of solvency or profitability

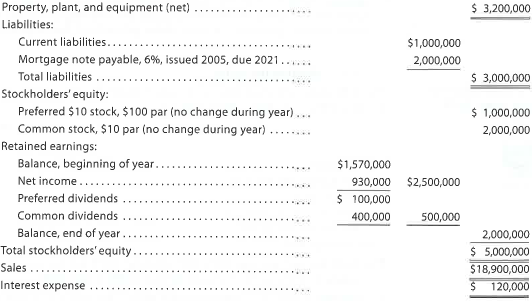

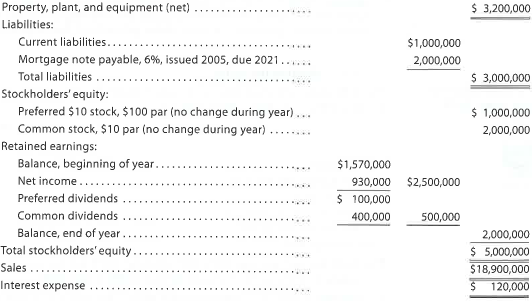

The following data were taken from the financial statements of Gates Inc. for the current fiscal year. Assuming that long-term investments totaled $3,000,000 throughout the year and that total assets were $7,000,000 at the beginning of the current fiscal year, determine the following: (a) ratio of fixed assets to long-term liabilities, (b) ratio of liabilities to stockholders' equity, (c) ratio of sales to assets, (d) rate earned on total assets, (e) rate earned on stockholders' equity, and (f) rate earned on common stockholders' equity. Round to one decimal place.

The following data were taken from the financial statements of Gates Inc. for the current fiscal year. Assuming that long-term investments totaled $3,000,000 throughout the year and that total assets were $7,000,000 at the beginning of the current fiscal year, determine the following: (a) ratio of fixed assets to long-term liabilities, (b) ratio of liabilities to stockholders' equity, (c) ratio of sales to assets, (d) rate earned on total assets, (e) rate earned on stockholders' equity, and (f) rate earned on common stockholders' equity. Round to one decimal place.

Explanation

Prepare Balance Sheet of Gates Inc.

The...

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255