Managerial Economics 2nd Edition by William Boyes

Edition 2ISBN: 978-0618988624

Managerial Economics 2nd Edition by William Boyes

Edition 2ISBN: 978-0618988624 Exercise 7

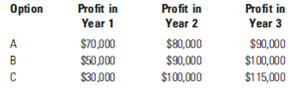

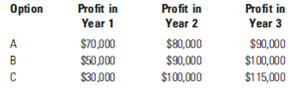

You have just been hired as a consultant to help a firm determine which of three options to take to increase shareholder wealth. The following table shows year-end profits for each option. Assume that the risk-free cost of capital is 5 percent and the risk premium is 8 percent.

a. Calculate the economic profit for each option.

b. Suppose that the profit figures are based on earnings figures of 10 times profits and that there are 100,000 shares of stock outstanding. What are the earnings per share for each option?

a. Calculate the economic profit for each option.

b. Suppose that the profit figures are based on earnings figures of 10 times profits and that there are 100,000 shares of stock outstanding. What are the earnings per share for each option?

Explanation

Cost of capital:

Opportunity cost for m...

Managerial Economics 2nd Edition by William Boyes

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255