Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778 Exercise 15

Evaluating Profitability and Liquidity

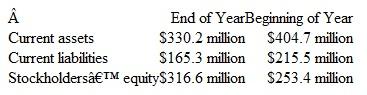

A recent annual report issued by hhgregg revealed the following data:

The company's income statement reported total annual revenue of $2,077.7 million and net income for the year of $48.2 million.

Instructions

a. Evaluate hhgregg 's profitability by computing its net income percentage and its return on equity for the year.

b. Evaluate hhgregg 's liquidity by computing its working capital and its current ratio at the beginning of the year and at the end of the year.

c. Does hhgregg appear to be both profitable and liquid? Explain.

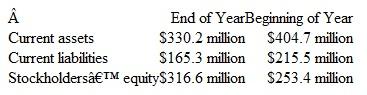

A recent annual report issued by hhgregg revealed the following data:

The company's income statement reported total annual revenue of $2,077.7 million and net income for the year of $48.2 million.

Instructions

a. Evaluate hhgregg 's profitability by computing its net income percentage and its return on equity for the year.

b. Evaluate hhgregg 's liquidity by computing its working capital and its current ratio at the beginning of the year and at the end of the year.

c. Does hhgregg appear to be both profitable and liquid? Explain.

Explanation

(a)

Net income percentage represents the...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255