Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778 Exercise 25

Correcting

Errors - Recording of Merchandising

Transactions

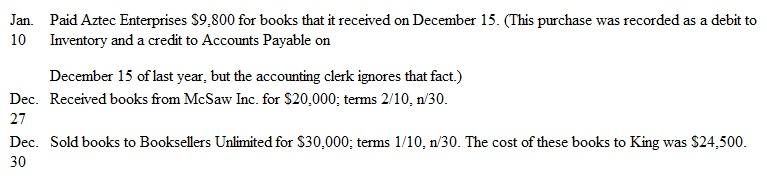

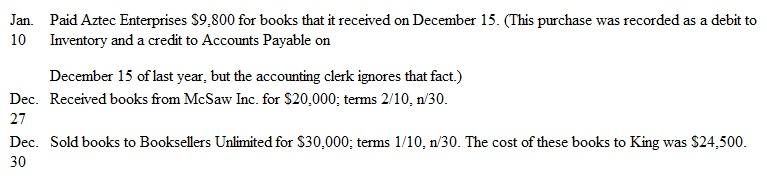

King Enterprises is a book wholesaler. King hired a new accounting clerk on January 1 of the current year. The new clerk does not understand accrual accounting and recorded the transactions below based on when cash receipts and disbursements changed hands rather than when the transaction occurred. King uses a perpetual inventory system, and its accounting policy calls for inventory purchases to be recorded net of any discounts offered.

Instructions

Instructions

a. As a result of the accounting clerk's errors, compute the amount by which the following accounts are overstated or understated.

1. Accounts Receivable

2. Inventory

3. Accounts Payable

4. Sales

5. Cost of Goods Sold

b. Compute the amount by which net income is overstated or understated.

c. Prepare a single journal entry to correct the errors that the accounting clerk has made. (Assume that King has yet to close its books for the current year.)

d. Assume that King has already closed its books for the current year. Make a single journal entry to correct the errors that the accounting clerk has made.

e. Assume that the ending inventory balance is correctly stated based on adjustments resulting from a physical inventory count. (Cost of Goods Sold was debited or credited based on the inventory adjustment.) Assume that King has already closed its books for the current year, and make a single journal entry to correct the errors that the accounting clerk has made.

Errors - Recording of Merchandising

Transactions

King Enterprises is a book wholesaler. King hired a new accounting clerk on January 1 of the current year. The new clerk does not understand accrual accounting and recorded the transactions below based on when cash receipts and disbursements changed hands rather than when the transaction occurred. King uses a perpetual inventory system, and its accounting policy calls for inventory purchases to be recorded net of any discounts offered.

Instructions

Instructions a. As a result of the accounting clerk's errors, compute the amount by which the following accounts are overstated or understated.

1. Accounts Receivable

2. Inventory

3. Accounts Payable

4. Sales

5. Cost of Goods Sold

b. Compute the amount by which net income is overstated or understated.

c. Prepare a single journal entry to correct the errors that the accounting clerk has made. (Assume that King has yet to close its books for the current year.)

d. Assume that King has already closed its books for the current year. Make a single journal entry to correct the errors that the accounting clerk has made.

e. Assume that the ending inventory balance is correctly stated based on adjustments resulting from a physical inventory count. (Cost of Goods Sold was debited or credited based on the inventory adjustment.) Assume that King has already closed its books for the current year, and make a single journal entry to correct the errors that the accounting clerk has made.

Explanation

a.

Entries that Should Have Been Recorde...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255