Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778 Exercise 22

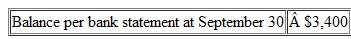

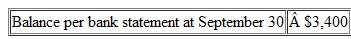

Assume that the following information relates to your most recent bank statement dated September 30:

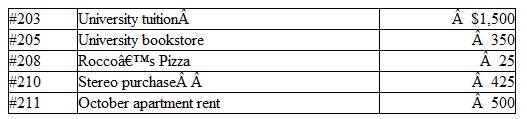

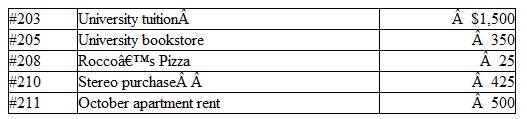

Checks written that had not cleared the bank as of September 30:

Checks written that had not cleared the bank as of September 30:

Interest amounting to $4 was credited to your account by the bank in September. The bank's service charge for the month was $5. In addition to your bank statement, you received a letter from your parents informing you that they had made a $2,400 electronic funds transfer directly into your account on October 2. After reading your parents' letter, you looked in your checkbook and discovered its balance was $601. Adding your parents' deposit brought that total to $3,001.

Interest amounting to $4 was credited to your account by the bank in September. The bank's service charge for the month was $5. In addition to your bank statement, you received a letter from your parents informing you that they had made a $2,400 electronic funds transfer directly into your account on October 2. After reading your parents' letter, you looked in your checkbook and discovered its balance was $601. Adding your parents' deposit brought that total to $3,001.

Prepare a bank reconciliation to determine your correct checking account balance. Explain why neither your bank statement nor your checkbook shows this amount.

Checks written that had not cleared the bank as of September 30:

Checks written that had not cleared the bank as of September 30: Interest amounting to $4 was credited to your account by the bank in September. The bank's service charge for the month was $5. In addition to your bank statement, you received a letter from your parents informing you that they had made a $2,400 electronic funds transfer directly into your account on October 2. After reading your parents' letter, you looked in your checkbook and discovered its balance was $601. Adding your parents' deposit brought that total to $3,001.

Interest amounting to $4 was credited to your account by the bank in September. The bank's service charge for the month was $5. In addition to your bank statement, you received a letter from your parents informing you that they had made a $2,400 electronic funds transfer directly into your account on October 2. After reading your parents' letter, you looked in your checkbook and discovered its balance was $601. Adding your parents' deposit brought that total to $3,001.Prepare a bank reconciliation to determine your correct checking account balance. Explain why neither your bank statement nor your checkbook shows this amount.

Explanation

a.

As shown above, your correct curre...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255