Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778 Exercise 14

Disposal of Plant Assets

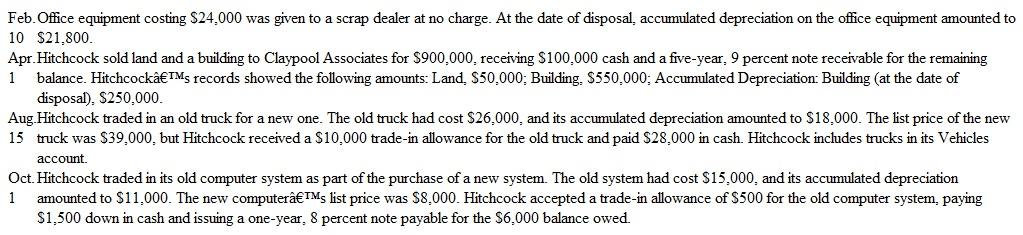

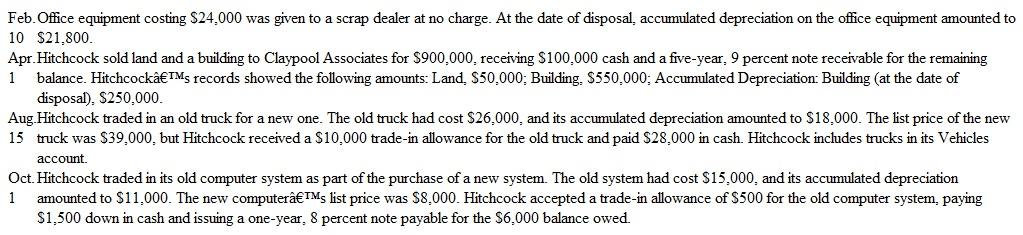

During the current year, Hitchcock Developers disposed of plant assets in the following transactions:

Instructions

a. Prepare journal entries to record each of the disposal transactions. Assume that depreciation expense on each asset has been recorded up to the date of disposal. Thus, you need not update the accumulated depreciation figures stated in the problem.

b. Will the gains and losses recorded in part a above affect the gross profit reported in Hitchcock's income statement? Explain.

c. Explain how the financial reporting of gains and losses on plant assets differs from the financial reporting of unrealized gains and losses on marketable securities discussed in Chapter 7.

During the current year, Hitchcock Developers disposed of plant assets in the following transactions:

Instructions

a. Prepare journal entries to record each of the disposal transactions. Assume that depreciation expense on each asset has been recorded up to the date of disposal. Thus, you need not update the accumulated depreciation figures stated in the problem.

b. Will the gains and losses recorded in part a above affect the gross profit reported in Hitchcock's income statement? Explain.

c. Explain how the financial reporting of gains and losses on plant assets differs from the financial reporting of unrealized gains and losses on marketable securities discussed in Chapter 7.

Explanation

Disposal of Plant assets refers to the s...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255