Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778 Exercise 60

Accounting for Goodwill

Jell Stores is considering expanding its operations to include the greater Portsmouth area. Rather than build new stores in Portsmouth, management plans to acquire existing stores and convert them into Jell outlets.

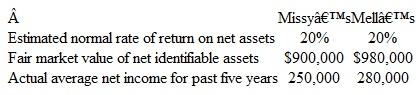

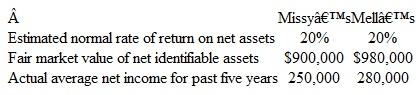

Jell is evaluating two similar acquisition opportunities. Information relating to each of these stores is presented below:

Instructions

a. Compute an estimated fair value for any goodwill associated with Jell purchasing Missy's. Base your computation upon an assumption that successful stores of this type typically sell at about 10 times their annual earnings.

b. Compute an estimated fair value for any goodwill associated with Jell purchasing Mell's. Base your computation upon an assumption that Jell's management wants to generate a target return on investment of 35 percent.

c. Many of Jell's existing stores are extremely profitable. If Jell acquires Missy's or Mell's, should it also record the goodwill associated with its existing locations? Explain.

Jell Stores is considering expanding its operations to include the greater Portsmouth area. Rather than build new stores in Portsmouth, management plans to acquire existing stores and convert them into Jell outlets.

Jell is evaluating two similar acquisition opportunities. Information relating to each of these stores is presented below:

Instructions

a. Compute an estimated fair value for any goodwill associated with Jell purchasing Missy's. Base your computation upon an assumption that successful stores of this type typically sell at about 10 times their annual earnings.

b. Compute an estimated fair value for any goodwill associated with Jell purchasing Mell's. Base your computation upon an assumption that Jell's management wants to generate a target return on investment of 35 percent.

c. Many of Jell's existing stores are extremely profitable. If Jell acquires Missy's or Mell's, should it also record the goodwill associated with its existing locations? Explain.

Explanation

Goodwill is an intangible asset. It is t...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255