Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778 Exercise 39

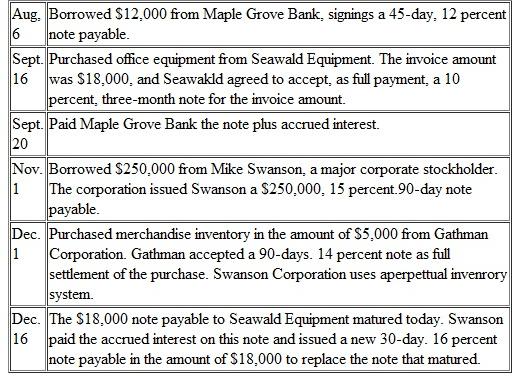

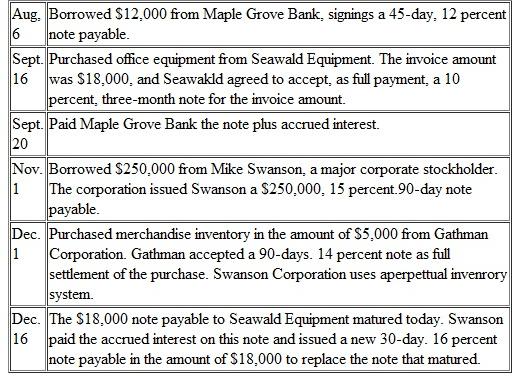

During the fiscal year ended December 31, Swanson Corporation engaged in the following transactions involving notes payable:

Instructions

Instructions

a. ?Prepare journal entries (in general journal form) to record the above transactions. Use a 360-day year in making the interest calculations.

b. ?Prepare the adjusting entry needed at December 31. prior to closing the accounts. Use one entry for all three notes (round to the nearest dollar).

c. ?Provide a possible explanation why the new 30-day note payable to Seawald Equipment pays 16 percent interest instead of the 10 percent rate charged on the September 16 note.

Instructions

Instructions a. ?Prepare journal entries (in general journal form) to record the above transactions. Use a 360-day year in making the interest calculations.

b. ?Prepare the adjusting entry needed at December 31. prior to closing the accounts. Use one entry for all three notes (round to the nearest dollar).

c. ?Provide a possible explanation why the new 30-day note payable to Seawald Equipment pays 16 percent interest instead of the 10 percent rate charged on the September 16 note.

Explanation

Note payable: Note payable is a current ...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255