Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778 Exercise 22

Accounting for Payroll Activities

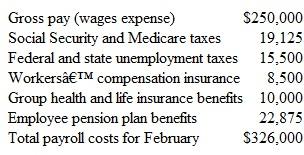

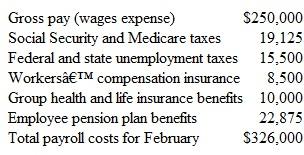

Spirit Corporation reported the following payroll-related costs for the month of February:

Spirit's insurance premiums for workers' compensation and group health and life insurance were paid for in a prior period and recorded initially as prepaid insurance expense. Withholdings from employee wages in February were as follows:

a. Record Spirit's gross wages, employee withholdings, and employee take-home pay for February.

b. Record Spirit's payroll tax expense for February.

c. Record Spirit's employee benefit expenses for February.

d. Do the amounts withheld from spirit's employees represent taxes levied on spirit Corporation? Explain.

Spirit Corporation reported the following payroll-related costs for the month of February:

Spirit's insurance premiums for workers' compensation and group health and life insurance were paid for in a prior period and recorded initially as prepaid insurance expense. Withholdings from employee wages in February were as follows:

a. Record Spirit's gross wages, employee withholdings, and employee take-home pay for February.

b. Record Spirit's payroll tax expense for February.

c. Record Spirit's employee benefit expenses for February.

d. Do the amounts withheld from spirit's employees represent taxes levied on spirit Corporation? Explain.

Explanation

(a)

Record Spirit's gross wages, employ...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255