Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778 Exercise 20

Deferred Income Taxes

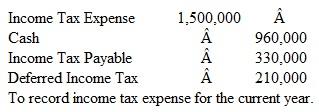

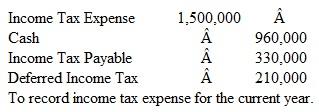

The following journal entry summarizes for the current year the income tax expense of Sophie's Software Warehouse:

Of the deferred income taxes, only $30,000 is classified as a current liability.

a. Define the term deferred income tax.

b. What is the amount of income tax that the company has paid or expects to pay in conjunction with its income tax return for the current year?

c. Illustrate the allocation of the liabilities shown in the above journal entry between the classifications of current liabilities and long-term liabilities.

The following journal entry summarizes for the current year the income tax expense of Sophie's Software Warehouse:

Of the deferred income taxes, only $30,000 is classified as a current liability.

a. Define the term deferred income tax.

b. What is the amount of income tax that the company has paid or expects to pay in conjunction with its income tax return for the current year?

c. Illustrate the allocation of the liabilities shown in the above journal entry between the classifications of current liabilities and long-term liabilities.

Explanation

a.

Deferred income tax:

Deferred incom...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255