Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778 Exercise 35

Preferred Stock Alternatives

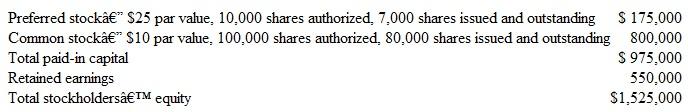

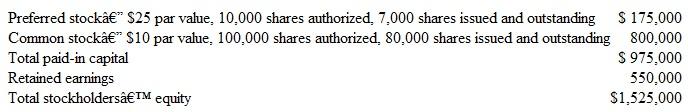

Easy Moncy, Inc., has the following capital structure:

The number of issued and outstanding shares of both preferred and common stock have been the same for the last two years. Dividends on preferred stock are 8 percent of par value and have been paid each year the stock was outstanding except for the immediate past year. In the current year, management declares a total dividend of $60,000. Indicate the amount that will be paid to both preferred and common stockholders assuming ( a ) the preferred stock is not cumulative and ( b ) the preferred stock is cumulative.

Easy Moncy, Inc., has the following capital structure:

The number of issued and outstanding shares of both preferred and common stock have been the same for the last two years. Dividends on preferred stock are 8 percent of par value and have been paid each year the stock was outstanding except for the immediate past year. In the current year, management declares a total dividend of $60,000. Indicate the amount that will be paid to both preferred and common stockholders assuming ( a ) the preferred stock is not cumulative and ( b ) the preferred stock is cumulative.

Explanation

Common stock

Common stock provides owne...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255