Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778 Exercise 60

Cash Dividends, Stock Dividends, and Stock Splits

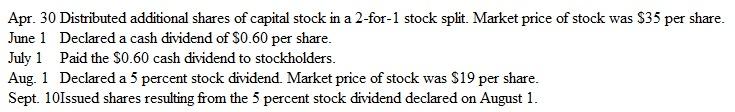

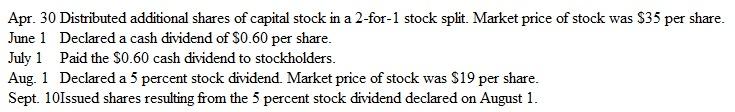

HiTech Manufacturing Company has 1,000,000 shares of $1 par value capital stock outstanding on January 1. The following equity transactions occurred during the current year:

a. Prepare journal entries to record the above transactions.

b. Compute the number of shares of capital stock outstanding at year-end.

c. What is the par value per share of HiTech Manufacturing stock at the end of the year?

d. Determine the effect of each of the following on total stockholders' equity: stock split, declaration and payment of a cash dividend, declaration and distribution of a stock dividend. (Your answers should be either increase, decrease, or no effect. )

HiTech Manufacturing Company has 1,000,000 shares of $1 par value capital stock outstanding on January 1. The following equity transactions occurred during the current year:

a. Prepare journal entries to record the above transactions.

b. Compute the number of shares of capital stock outstanding at year-end.

c. What is the par value per share of HiTech Manufacturing stock at the end of the year?

d. Determine the effect of each of the following on total stockholders' equity: stock split, declaration and payment of a cash dividend, declaration and distribution of a stock dividend. (Your answers should be either increase, decrease, or no effect. )

Explanation

(a)

Record Journal entries in the books...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255