Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778 Exercise 26

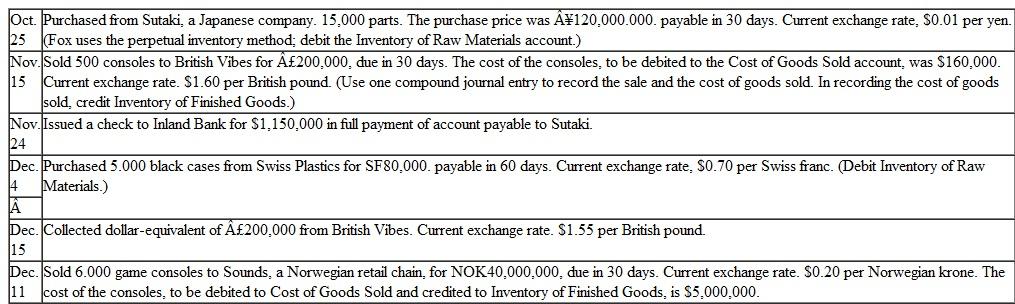

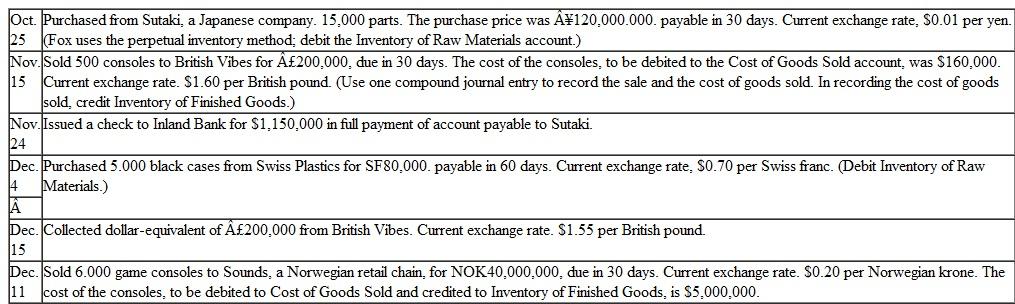

Fox Games is a U.S. company that manufacturers computer game consoles. Many of the components for the consoles are purchased abroad, and the finished product is sold in foreign countries as well as in the United States. Among the recent transactions of Fox are the following:

Instructions

Instructions

a. Prepare in general journal form the entries necessary to record the preceding transactions.

b. Prepare the adjusted entries needed at December 31 for the SF80,000 account payable to Swiss Plastics and the NOK40,000,000 account receivable from Sounds. Year-end exchange rates, $0.68 per Swiss franc and $0.18 per Norwegian krone. (Use a separate journal entry to adjust each account balance.)

c. Compute (to the nearest dollar) the unit sales price of consoles in U.S. dollars in both the November 15 and the December 11 sales transaction. (The sales price may not be the same in each transaction.)

d. Compute the exchange rate for the yen, stated in U.S. dollars, on November 24.

e. Explain how Fox Games could have hedged its position to reduce the risk of loss from exchange rate fluctuations on ( 1 ) its foreign payables and ( 2 ) its foreign receivables.

Instructions

Instructions a. Prepare in general journal form the entries necessary to record the preceding transactions.

b. Prepare the adjusted entries needed at December 31 for the SF80,000 account payable to Swiss Plastics and the NOK40,000,000 account receivable from Sounds. Year-end exchange rates, $0.68 per Swiss franc and $0.18 per Norwegian krone. (Use a separate journal entry to adjust each account balance.)

c. Compute (to the nearest dollar) the unit sales price of consoles in U.S. dollars in both the November 15 and the December 11 sales transaction. (The sales price may not be the same in each transaction.)

d. Compute the exchange rate for the yen, stated in U.S. dollars, on November 24.

e. Explain how Fox Games could have hedged its position to reduce the risk of loss from exchange rate fluctuations on ( 1 ) its foreign payables and ( 2 ) its foreign receivables.

Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255