Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778 Exercise 47

Financial Statement Harmonization

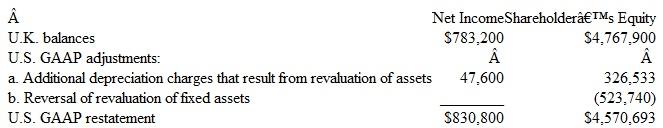

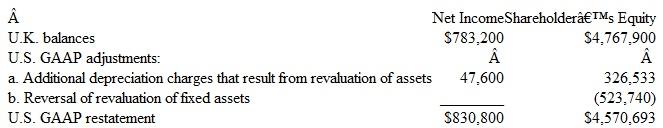

Refer to Exhibit 15-6 in this chapter. Assume a United Kingdom company, Brits International, lists on both the London Exchange using U.K. GAAP and the New York Stock Exchange. Brits International must prepare a reconciliation from U.K. GAAP to U.S. GAAP. This reconciliation shows the following difference associated with revaluations of fixed assets:

Required:

a. Explain why the adjustment to U.S. GAAP resulted in additions to net income.

b. Explain why there are additions to shareholders' equity and why those additions are greater than the additions to net income.

c. Explain why there is a deduction to shareholders' equity.

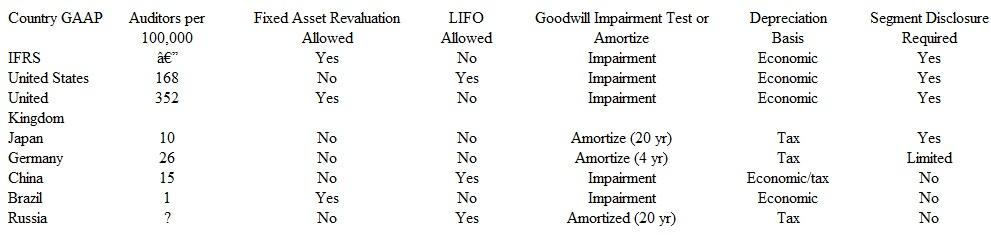

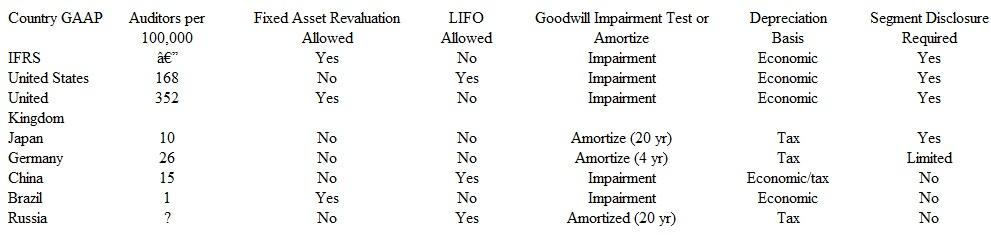

EXHIBIT 15-6 Global Variation in Accounting Practices

Refer to Exhibit 15-6 in this chapter. Assume a United Kingdom company, Brits International, lists on both the London Exchange using U.K. GAAP and the New York Stock Exchange. Brits International must prepare a reconciliation from U.K. GAAP to U.S. GAAP. This reconciliation shows the following difference associated with revaluations of fixed assets:

Required:

a. Explain why the adjustment to U.S. GAAP resulted in additions to net income.

b. Explain why there are additions to shareholders' equity and why those additions are greater than the additions to net income.

c. Explain why there is a deduction to shareholders' equity.

EXHIBIT 15-6 Global Variation in Accounting Practices

Explanation

a.

Adjustment of the additional deprecia...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255