Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778 Exercise 20

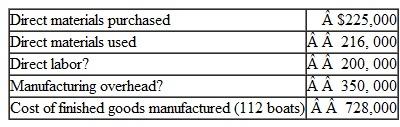

Aqua-Marine manufactures fiberglass fishing boats. The manufacturing costs incurred during its first year of operations are shown as follows:

During the year, 112 completed boats were manufactured, of which 100 were sold. (Assume that the amount of the ending inventory of finished goods and the cost of goods sold are determined using the average per-unit cost of manufacturing a completed boat.)

During the year, 112 completed boats were manufactured, of which 100 were sold. (Assume that the amount of the ending inventory of finished goods and the cost of goods sold are determined using the average per-unit cost of manufacturing a completed boat.)

Instructions

a. Compute each of the following and show all computations:

1. The average per-unit cost of manufacturing a completed boat during the current year.

2. The year-end balances of the inventories of materials, work in process, and finished goods.

3. The cost of goods sold during the year.

b. For the current year, the costs of direct materials purchased, direct labor assigned to production, and actual manufacturing overhead total $775,000. Is this the amount of manufacturing costs deducted from revenue in the current year? Explain fully.

During the year, 112 completed boats were manufactured, of which 100 were sold. (Assume that the amount of the ending inventory of finished goods and the cost of goods sold are determined using the average per-unit cost of manufacturing a completed boat.)

During the year, 112 completed boats were manufactured, of which 100 were sold. (Assume that the amount of the ending inventory of finished goods and the cost of goods sold are determined using the average per-unit cost of manufacturing a completed boat.)Instructions

a. Compute each of the following and show all computations:

1. The average per-unit cost of manufacturing a completed boat during the current year.

2. The year-end balances of the inventories of materials, work in process, and finished goods.

3. The cost of goods sold during the year.

b. For the current year, the costs of direct materials purchased, direct labor assigned to production, and actual manufacturing overhead total $775,000. Is this the amount of manufacturing costs deducted from revenue in the current year? Explain fully.

Explanation

(a)

(1) Average per-unit cost = [Cost o...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255