Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778 Exercise 11

Preparing an Income Statement Using the Cost of Finished Goods Manufactured

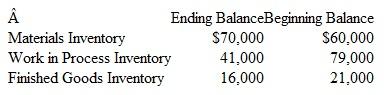

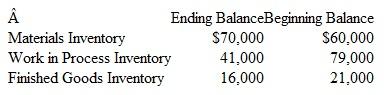

Randolph Company reports the following information pertaining to its operating activities:

During the year, the company purchased $135,000 of direct materials and incurred $22,000 of direct labor costs. Total manufacturing overhead costs for the year amounted to $19,000. Selling and administrative expenses amounted to $30,000, and the company's annual sales amounted to $280,000.

a. Prepare Randolph's schedule of the cost of finished goods manufactured.

b. Prepare Randolph's income statement (ignore income taxes).

Randolph Company reports the following information pertaining to its operating activities:

During the year, the company purchased $135,000 of direct materials and incurred $22,000 of direct labor costs. Total manufacturing overhead costs for the year amounted to $19,000. Selling and administrative expenses amounted to $30,000, and the company's annual sales amounted to $280,000.

a. Prepare Randolph's schedule of the cost of finished goods manufactured.

b. Prepare Randolph's income statement (ignore income taxes).

Explanation

Cost of goods manufactured:

Cost of goo...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255