Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778 Exercise 56

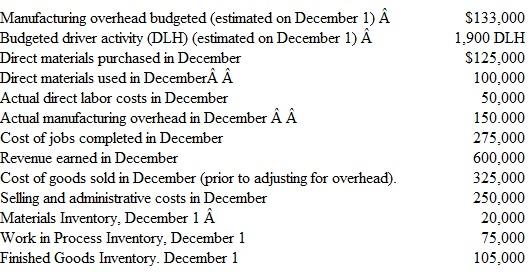

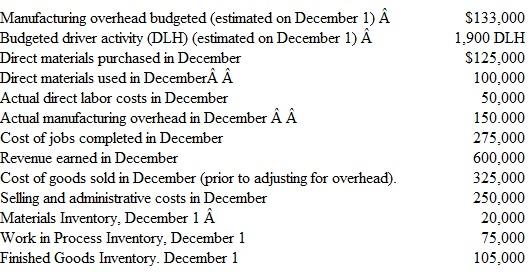

Crenshaw uses a job order costing system to account for projects. It applies manufacturing overhead to jobs on the basis of direct labor hours and pays its direct labor workers.$25 per hour. The following relates to activity for the month of December:

a. Record the purchase of direct materials in December. Assume all purchases are made on account.

a. Record the purchase of direct materials in December. Assume all purchases are made on account.

b. Record the cost of direct materials applied to jobs in December.

c. Record the cost of direct labor applied to jobs in December.

d. Record the actual cost of manufacturing overhead incurred in December. Assume all overhead costs were paid in cash.

e. Record the cost of manufacturing overhead applied to jobs in December.

f. Record revenue and the related cost of jobs sold in December. Assume all sales are made on account.

g. Record December selling and administrative costs. Assume all selling and administrative costs were paid in cash.

h. Close the Manufacturing Overhead account directly to Cost of Goods Sold on December 31.

i. Compute the company's December income. Ignore taxes.

a. Record the purchase of direct materials in December. Assume all purchases are made on account.

a. Record the purchase of direct materials in December. Assume all purchases are made on account. b. Record the cost of direct materials applied to jobs in December.

c. Record the cost of direct labor applied to jobs in December.

d. Record the actual cost of manufacturing overhead incurred in December. Assume all overhead costs were paid in cash.

e. Record the cost of manufacturing overhead applied to jobs in December.

f. Record revenue and the related cost of jobs sold in December. Assume all sales are made on account.

g. Record December selling and administrative costs. Assume all selling and administrative costs were paid in cash.

h. Close the Manufacturing Overhead account directly to Cost of Goods Sold on December 31.

i. Compute the company's December income. Ignore taxes.

Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255