Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778 Exercise 6

Computing the Break-Even Point

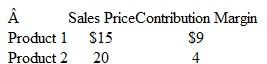

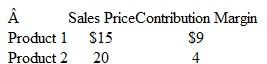

Malibu Corporation has monthly fixed costs of $96,000. It sells two products for which it has provided the following information:

a. What total monthly sales revenue is required to break even if the relative sales mix is 30 percent for Product 1 and 70 percent for Product 2?

b. What total monthly sales revenue is required to earn a monthly operating income of $16,000 if the relative sales mix is 20 percent for Product 1 and 80 percent for Product 2?

Malibu Corporation has monthly fixed costs of $96,000. It sells two products for which it has provided the following information:

a. What total monthly sales revenue is required to break even if the relative sales mix is 30 percent for Product 1 and 70 percent for Product 2?

b. What total monthly sales revenue is required to earn a monthly operating income of $16,000 if the relative sales mix is 20 percent for Product 1 and 80 percent for Product 2?

Explanation

Break Even Sales

It is the amount of un...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255