Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778 Exercise 35

Budgeting Manufacturing Overhead

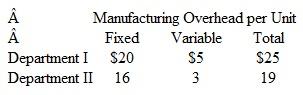

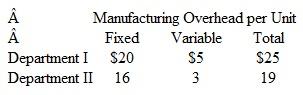

Wells Enterprises manufactures a component that is processed successively by Department I and Department II. Manufacturing overhead is applied to units produced at the following budget costs:

These budgeted overhead costs per unit are based on the normal volume of production of 6,000 units per month. In January, variable manufacturing overhead in Department II is expected to be 20 percent above budget because of major scheduled repairs to equipment. The company plans to produce 10,000 units during January.

Prepare a budget for manufacturing overhead costs in January using three column headings: Total, Department I, and Department II.

Wells Enterprises manufactures a component that is processed successively by Department I and Department II. Manufacturing overhead is applied to units produced at the following budget costs:

These budgeted overhead costs per unit are based on the normal volume of production of 6,000 units per month. In January, variable manufacturing overhead in Department II is expected to be 20 percent above budget because of major scheduled repairs to equipment. The company plans to produce 10,000 units during January.

Prepare a budget for manufacturing overhead costs in January using three column headings: Total, Department I, and Department II.

Explanation

Prepare a budget for manufacturing overh...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255