Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Edition 17ISBN: 978-0078025778 Exercise 18

Computations for the DuPont Model

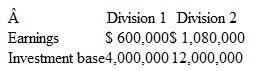

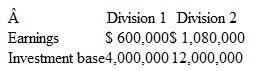

Saxwell Corporation has many divisions and evaluates them using ROI. The corporation's expected ROI for each division is 10 percent or above.

Compute the ROI for Divisions 1 and 2. Are the divisions meeting the expected ROI? What other information would you want to know about the investment base before comparing Division 1 and 2 performance?

Saxwell Corporation has many divisions and evaluates them using ROI. The corporation's expected ROI for each division is 10 percent or above.

Compute the ROI for Divisions 1 and 2. Are the divisions meeting the expected ROI? What other information would you want to know about the investment base before comparing Division 1 and 2 performance?

Explanation

Return on Investment (ROI): Return on in...

Financial & Managerial Accounting 17th Edition by Jan Williams ,Susan Haka,Mark Bettner,Joseph Carcello

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255