Business Driven Technology 6th Edition by Paige Baltzan

Edition 6ISBN: 9780073376905

Business Driven Technology 6th Edition by Paige Baltzan

Edition 6ISBN: 9780073376905 Exercise 190

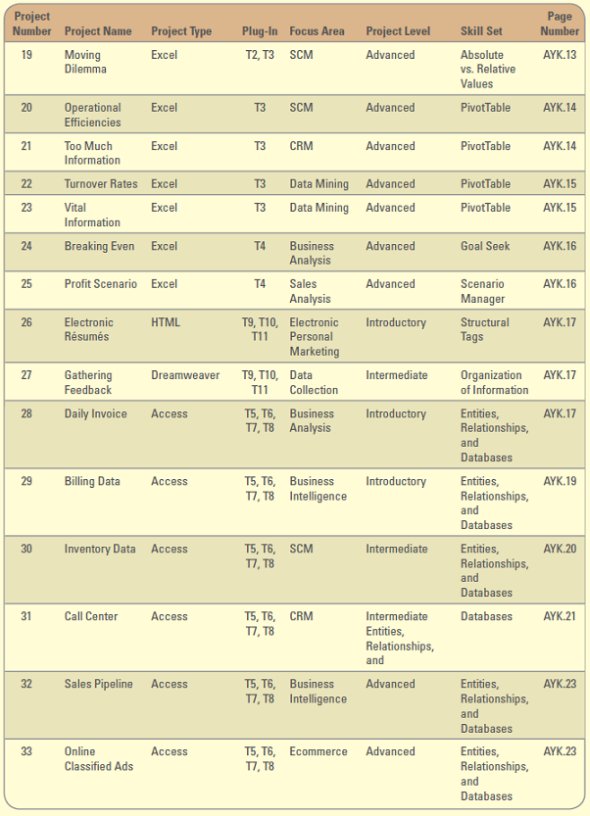

Adequate Acquisitions

XMark.com is a major Internet company specializing in organic food. XMark.com is thinking of purchasing GoodGrow, another organic food Internet company. GoodGrow has current revenues of $100 million, with expenses of $150 million. Current projections indicate that GoodGrow's revenues are increasing at 35 percent per year and its expenses are increasing by 10 percent per year. XMark.com understands that projections can be erroneous, however; the company must determine the number of years before GoodGrow will return a profit.

Project Focus

You need to help XMark.com determine the number of years required to break even, using annual growth rates in revenue between 20 percent and 60 percent and annual expense growth rates between 10 percent and 30 percent. You have been provided with a template, AYK13_Data.xlsx, to assist with your analysis.

Data File: AYK13_Data.xlsx

Explanation

Company X want to determine the number o...

Business Driven Technology 6th Edition by Paige Baltzan

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255