Accounting Information Systems 1st Edition by Vernon Richardson,Chengyee Chang ,Rod Smith

Edition 1ISBN: 978-0078025495

Accounting Information Systems 1st Edition by Vernon Richardson,Chengyee Chang ,Rod Smith

Edition 1ISBN: 978-0078025495 Exercise 23

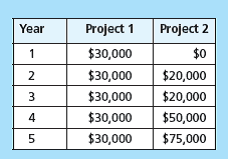

Sunset Graphics is considering two mutually exclusive projects. Both require an initial investment of $100,000. Assume a marginal interest rate of 10 percent and no residual value for either investment. The cash flows for the two projects are expected to be the following:

a. Compute the NPV, payback, and IRR for both projects. Which is most desirable?

b. Assume straight-line depreciation is used for both projects; compute the accounting rate of return. What do you think of the ARR criterion?

c. Assume a change in interest rate to 15 percent. Does that change your views on which project the company should adopt?

d. Assume a change in interest rate to 6 percent. Does that change your views on which project the company should adopt?

e. For investments in technology, which cash inflow projection is most likely?

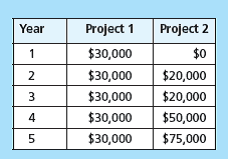

a. Compute the NPV, payback, and IRR for both projects. Which is most desirable?

b. Assume straight-line depreciation is used for both projects; compute the accounting rate of return. What do you think of the ARR criterion?

c. Assume a change in interest rate to 15 percent. Does that change your views on which project the company should adopt?

d. Assume a change in interest rate to 6 percent. Does that change your views on which project the company should adopt?

e. For investments in technology, which cash inflow projection is most likely?

Explanation

In the present case, the two projects ha...

Accounting Information Systems 1st Edition by Vernon Richardson,Chengyee Chang ,Rod Smith

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255