Managerial Accounting 14th Edition by Ray Garrison ,Eric Noreen ,Peter Brewer 4

Edition 14ISBN: 978-0077909703

Managerial Accounting 14th Edition by Ray Garrison ,Eric Noreen ,Peter Brewer 4

Edition 14ISBN: 978-0077909703 Exercise 2

Financial Ratios for Common Stockholders

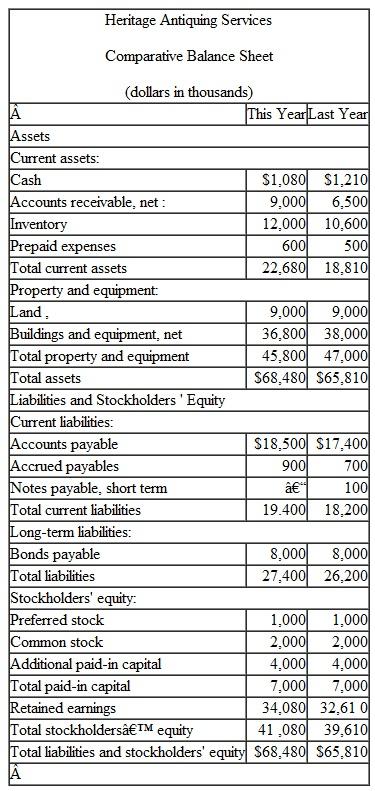

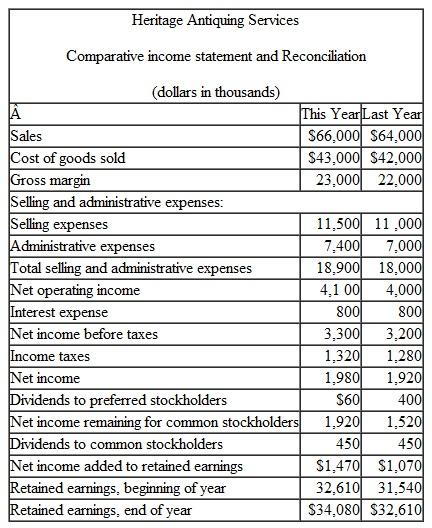

Comparative financial statements for Heritage Antiquing Services for the fiscal year ending December 31 appear on the following page. The company did not issue any new common or preferred stock during the year. A total of 600 thousand shares of common stock were outstanding. The interest rate on the bond payable was 14%. the income tax rate was 40% , and the dividend per share of common stock was $0.75. The market value of the company's common stock at the end of the year was $26. All of the company's sales are on account.

Required:

Required:

Compute the following financial ratios for common stockholders for this year:

1. Gross margin percentage.

2. Earnings per share of common stock.

3. Price-earnings ratio.

4. Dividend payout ratio.

5. Dividend yield ratio.

6. Return on total assets.

7. Return on common stockholders' equity.

8. Book value per share.

Comparative financial statements for Heritage Antiquing Services for the fiscal year ending December 31 appear on the following page. The company did not issue any new common or preferred stock during the year. A total of 600 thousand shares of common stock were outstanding. The interest rate on the bond payable was 14%. the income tax rate was 40% , and the dividend per share of common stock was $0.75. The market value of the company's common stock at the end of the year was $26. All of the company's sales are on account.

Required:

Required: Compute the following financial ratios for common stockholders for this year:

1. Gross margin percentage.

2. Earnings per share of common stock.

3. Price-earnings ratio.

4. Dividend payout ratio.

5. Dividend yield ratio.

6. Return on total assets.

7. Return on common stockholders' equity.

8. Book value per share.

Explanation

1)Gross margin percentage can be calcula...

Managerial Accounting 14th Edition by Ray Garrison ,Eric Noreen ,Peter Brewer 4

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255