Real Estate Finance & Investments 15th Edition by William Brueggeman, Jeffrey Fisher

Edition 15ISBN: 978-0073377353

Real Estate Finance & Investments 15th Edition by William Brueggeman, Jeffrey Fisher

Edition 15ISBN: 978-0073377353 Exercise 1

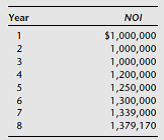

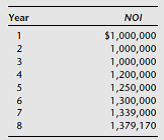

Zenith Investment Company is considering the purchase of an office property. It has done an extensive market analysis and has estimated that based on current market supply/demand relationships, rents, and its estimate of operating expenses, annual NOI will be as follows:

A market that is currently oversupplied is expected to result in cash flows remaining flat for the next three years at $1,000,000. During years 4, 5, and 6, market rents are expected to be higher. It is further expected that beginning in year 7 and every year thereafter, NOI will tend to reflect a stable, balanced market and should grow at 3 percent per year indefinitely. Zenith believes that investors should earn a 12 percent return ( r ) on an investment of this kind.

a. Assuming that the investment is expected to produce NOI in years 1-8 and is expected to be owned for seven years and then sold, what would be the value for this property today

( Hint: Begin by estimating the reversion value at the end of year 7. Recall that the expected IRR = 12% and the growth rate ( g ) in year 8 and beyond is estimated to remain level at 3%.)

b. What would the terminal capitalization rate ( R T ) be at the end of year 7

c. What would the "going-in" capitalization rate ( R ) be based on year 1 NOI

d. What explains the difference between the "going-in" and terminal cap rates

A market that is currently oversupplied is expected to result in cash flows remaining flat for the next three years at $1,000,000. During years 4, 5, and 6, market rents are expected to be higher. It is further expected that beginning in year 7 and every year thereafter, NOI will tend to reflect a stable, balanced market and should grow at 3 percent per year indefinitely. Zenith believes that investors should earn a 12 percent return ( r ) on an investment of this kind.

a. Assuming that the investment is expected to produce NOI in years 1-8 and is expected to be owned for seven years and then sold, what would be the value for this property today

( Hint: Begin by estimating the reversion value at the end of year 7. Recall that the expected IRR = 12% and the growth rate ( g ) in year 8 and beyond is estimated to remain level at 3%.)

b. What would the terminal capitalization rate ( R T ) be at the end of year 7

c. What would the "going-in" capitalization rate ( R ) be based on year 1 NOI

d. What explains the difference between the "going-in" and terminal cap rates

Explanation

Valuation of property

Z investment is c...

Real Estate Finance & Investments 15th Edition by William Brueggeman, Jeffrey Fisher

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255