Real Estate Finance & Investments 15th Edition by William Brueggeman, Jeffrey Fisher

Edition 15ISBN: 978-0073377353

Real Estate Finance & Investments 15th Edition by William Brueggeman, Jeffrey Fisher

Edition 15ISBN: 978-0073377353 Exercise 5

You have been asked to evaluate returns from your commercial real estate investment fund (Bluestone Fund) against an industry benchmark index to determine how successful your "active" investment strategy has been. Specifically, a potential client wants you to compare the performance of your portfolio strategy against a "passive" strategy of simply investing based on the same proportions of properties and locations comprising the index.

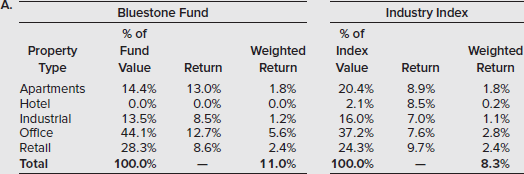

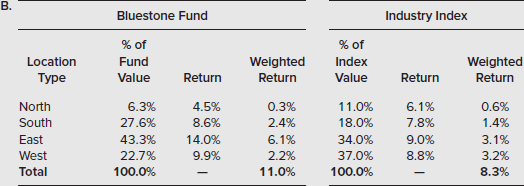

During the most current quarter, the following information has been provided to you based on property type and location:

a. Calculate the extent to which the Bluestone Fund is over- or (under)weighted by property type relative to the industry index.

b. Calculate the extent to which the Bluestone Fund is over- or (under)weighted by location/region relative to the industry index.

c. To what extent was the superior performance by Bluestone attributable to property selection and allocation in (A)

d. To what extent was the superior performance by Bluestone attributable to property selection and allocation in (B)

e. Assuming that the standard deviation of returns for its Bluestone Fund was 10.0 and 9.0 for index returns, what may be said about the relative risk for the two funds

During the most current quarter, the following information has been provided to you based on property type and location:

a. Calculate the extent to which the Bluestone Fund is over- or (under)weighted by property type relative to the industry index.

b. Calculate the extent to which the Bluestone Fund is over- or (under)weighted by location/region relative to the industry index.

c. To what extent was the superior performance by Bluestone attributable to property selection and allocation in (A)

d. To what extent was the superior performance by Bluestone attributable to property selection and allocation in (B)

e. Assuming that the standard deviation of returns for its Bluestone Fund was 10.0 and 9.0 for index returns, what may be said about the relative risk for the two funds

Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Real Estate Finance & Investments 15th Edition by William Brueggeman, Jeffrey Fisher

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255