Essentials of Accounting for Governmental and Not-for-Profit Organizations 10th Edition by Paul Copley, John Engstrom

Edition 10ISBN: 9780073527055

Essentials of Accounting for Governmental and Not-for-Profit Organizations 10th Edition by Paul Copley, John Engstrom

Edition 10ISBN: 9780073527055 Exercise 3

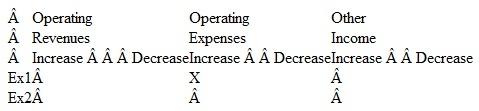

For each of the following transactions and events, indicate the effect it will have on each of the three categories appearing in the Statement of Operations for a not-for-profit health care organization.

Put an X in the appropriate column. If the net assets are unaffected, leave the column blank.

Ex1: Recorded nursing salaries of $16,000.

Ex1: Recorded nursing salaries of $16,000.

Ex2: Collected $10,000 on patient accounts receivable.

1. A capital campaign in support of a new building brought in pledges of $50,000.

2. $5,000 was expended from the capital campaign on architects' fees. The organization records all fixed assets in the unrestricted class of net assets.

3. Estimate that the amounts collected from third-party payors will be $22,000 less than the amount billed, due to contractual adjustment.

4. Estimate that the amounts collected from individual patients will be $10,000 less than the amount billed.

5. Performed charity care of $6,000 (at normal billing rates).

6. Unrestricted income on endowments amounted to $5,000.

7. Interest expense totaled $850.

8. Investment income limited by board action for capital improvement amounted to $240.

9. Determined depreciation on plant and equipment to be $12,000.

10. Received $500 in unrestricted contributions.

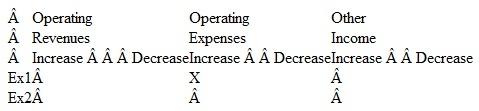

Put an X in the appropriate column. If the net assets are unaffected, leave the column blank.

Ex1: Recorded nursing salaries of $16,000.

Ex1: Recorded nursing salaries of $16,000.Ex2: Collected $10,000 on patient accounts receivable.

1. A capital campaign in support of a new building brought in pledges of $50,000.

2. $5,000 was expended from the capital campaign on architects' fees. The organization records all fixed assets in the unrestricted class of net assets.

3. Estimate that the amounts collected from third-party payors will be $22,000 less than the amount billed, due to contractual adjustment.

4. Estimate that the amounts collected from individual patients will be $10,000 less than the amount billed.

5. Performed charity care of $6,000 (at normal billing rates).

6. Unrestricted income on endowments amounted to $5,000.

7. Interest expense totaled $850.

8. Investment income limited by board action for capital improvement amounted to $240.

9. Determined depreciation on plant and equipment to be $12,000.

10. Received $500 in unrestricted contributions.

Explanation

There will be generally three types of a...

Essentials of Accounting for Governmental and Not-for-Profit Organizations 10th Edition by Paul Copley, John Engstrom

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255