Managerial Economics 13th Edition by James McGuigan,Charles Moyer,Frederick Harris

Edition 13ISBN: 978-1285420929

Managerial Economics 13th Edition by James McGuigan,Charles Moyer,Frederick Harris

Edition 13ISBN: 978-1285420929 Exercise 6

INTERNATIONAL PERSPECTIVES

The Superjumbo Dilemma 25

Boeing finishes assembly of wide-bodied commercial aircraft in several sizes at the rate of about one per day. Customers first pay a deposit of one-third of $84 to $127 million for a 767, one-third of $134 to $185 million for a 777, and one-third of $165 to $200 million for a 747, depending on how the planes are equipped. The second third is due after final assembly when the aircraft is painted, and the final third is due at delivery. Final assembly requires 15-25 days, the entire production schedule is 11 months long, and of course, design modifications add months to the front end of each project. The largest of the Boeing planes (the 747-400) carries 432 passengers; by comparison, the largest Airbus plane (the A380) carries 550 passengers.

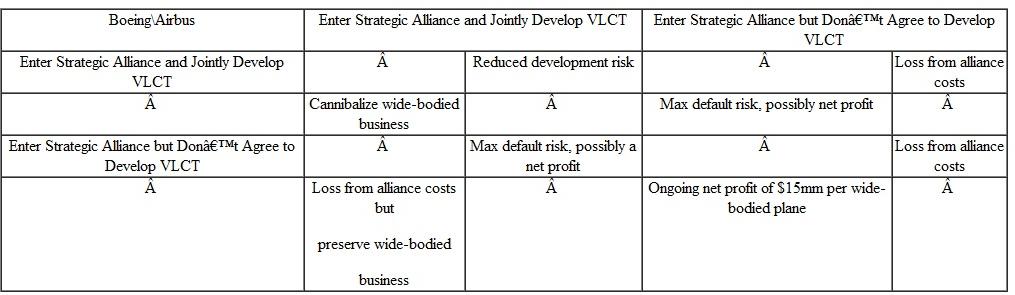

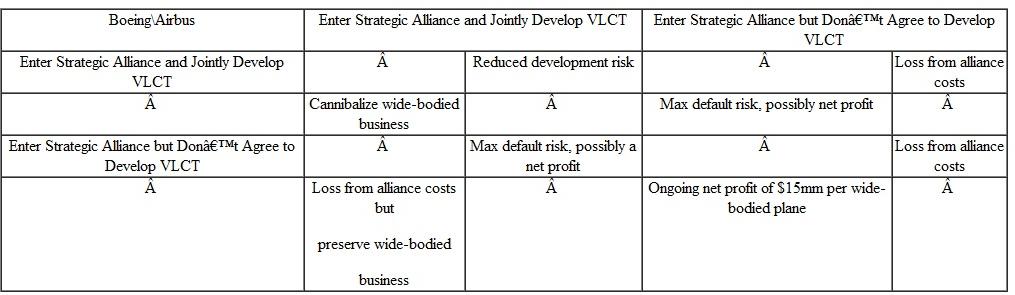

As early as 1993, Boeing and Airbus entered into discussions to jointly develop a very large commercial transport (VLCT) with perhaps 1,000 seats. If each firm proceeded independently, the market for VLCTs is so small relative to the massive R D costs that sizeable losses were assured. Either firm had superior profit available if it proceeded alone. Analyze this simultaneous play noncooperative product development game and predict what Boeing and Airbus would do and why.

In fact, both competitors decided to enter into a strategic alliance with the option to develop a superjumbo or withdraw and maintain a wide-bodied aircraft focus. Analyze Boeing's decision in light of its $45 million contribution margin on each 747 produced and sold. Net operating profit is about $15 million.

By 2010, Airbus was projecting to deliver 93 A380s. Instead, because of delays associated with installation misdesign for the electrical harnesses, Airbus delivered only 10 planes. The cost of the delay added $6 billion to the overall development costs to be recovered. That implies the break-even production run has now risen from 250 to over 300 planes. The company has produced 45 planes each of the last two years. What about the history of Boeing's 747 production run that suggests the Airbus 380 may still be a considerable success

By 2010, Airbus was projecting to deliver 93 A380s. Instead, because of delays associated with installation misdesign for the electrical harnesses, Airbus delivered only 10 planes. The cost of the delay added $6 billion to the overall development costs to be recovered. That implies the break-even production run has now risen from 250 to over 300 planes. The company has produced 45 planes each of the last two years. What about the history of Boeing's 747 production run that suggests the Airbus 380 may still be a considerable success

The Superjumbo Dilemma 25

Boeing finishes assembly of wide-bodied commercial aircraft in several sizes at the rate of about one per day. Customers first pay a deposit of one-third of $84 to $127 million for a 767, one-third of $134 to $185 million for a 777, and one-third of $165 to $200 million for a 747, depending on how the planes are equipped. The second third is due after final assembly when the aircraft is painted, and the final third is due at delivery. Final assembly requires 15-25 days, the entire production schedule is 11 months long, and of course, design modifications add months to the front end of each project. The largest of the Boeing planes (the 747-400) carries 432 passengers; by comparison, the largest Airbus plane (the A380) carries 550 passengers.

As early as 1993, Boeing and Airbus entered into discussions to jointly develop a very large commercial transport (VLCT) with perhaps 1,000 seats. If each firm proceeded independently, the market for VLCTs is so small relative to the massive R D costs that sizeable losses were assured. Either firm had superior profit available if it proceeded alone. Analyze this simultaneous play noncooperative product development game and predict what Boeing and Airbus would do and why.

In fact, both competitors decided to enter into a strategic alliance with the option to develop a superjumbo or withdraw and maintain a wide-bodied aircraft focus. Analyze Boeing's decision in light of its $45 million contribution margin on each 747 produced and sold. Net operating profit is about $15 million.

By 2010, Airbus was projecting to deliver 93 A380s. Instead, because of delays associated with installation misdesign for the electrical harnesses, Airbus delivered only 10 planes. The cost of the delay added $6 billion to the overall development costs to be recovered. That implies the break-even production run has now risen from 250 to over 300 planes. The company has produced 45 planes each of the last two years. What about the history of Boeing's 747 production run that suggests the Airbus 380 may still be a considerable success

By 2010, Airbus was projecting to deliver 93 A380s. Instead, because of delays associated with installation misdesign for the electrical harnesses, Airbus delivered only 10 planes. The cost of the delay added $6 billion to the overall development costs to be recovered. That implies the break-even production run has now risen from 250 to over 300 planes. The company has produced 45 planes each of the last two years. What about the history of Boeing's 747 production run that suggests the Airbus 380 may still be a considerable successExplanation

The production planning of the airlines ...

Managerial Economics 13th Edition by James McGuigan,Charles Moyer,Frederick Harris

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255