Managerial Economics 12th Edition by Christopher Thomas,Charles Maurice

Edition 12ISBN: 978-0078021909

Managerial Economics 12th Edition by Christopher Thomas,Charles Maurice

Edition 12ISBN: 978-0078021909 Exercise 2

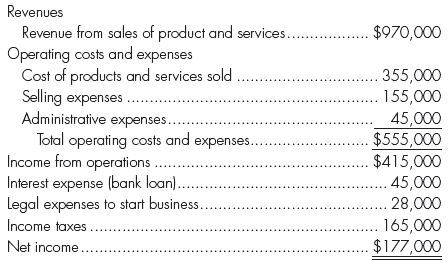

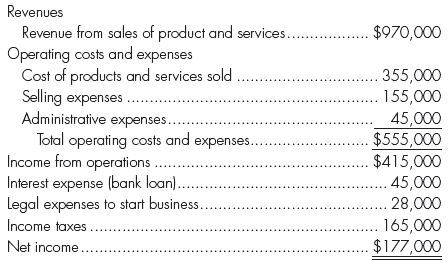

At the beginning of the year, an audio engineer quit his job and gave up a salary of $175,000 per year in order to start his own business, Sound Devices, Inc. The new company builds, installs, and maintains custom audio equipment for businesses that require high-quality audio systems. A partial income statement for the first year of operation for Sound Devices, Inc., is shown below:

To get started, the owner of Sound Devices spent $100,000 of his personal savings to pay for some of the capital equipment used in the business. During the first year of operation, the owner of Sound Devices could have earned a 15 percent return by investing in stocks of other new businesses with risk levels similar to the risk level at Sound Devices.

a. What are the total explicit, total implicit, and total economic costs for the year?

b. What is accounting profit?

c. What is economic profit?

d. Given your answer in part c, evaluate the owner's decision to leave his job to start Sound Devices.

To get started, the owner of Sound Devices spent $100,000 of his personal savings to pay for some of the capital equipment used in the business. During the first year of operation, the owner of Sound Devices could have earned a 15 percent return by investing in stocks of other new businesses with risk levels similar to the risk level at Sound Devices.

a. What are the total explicit, total implicit, and total economic costs for the year?

b. What is accounting profit?

c. What is economic profit?

d. Given your answer in part c, evaluate the owner's decision to leave his job to start Sound Devices.

Explanation

An audio engineer started his own business leaving his job where he was earning a salary of $175,000 per year. And he spent his savings to start his business which could earn an interest of $15,000.

a.

The following point explains various cost and income during his business:

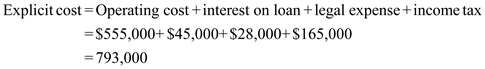

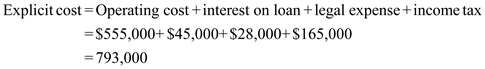

Explicit cost refers to the cost of using outside resources. Examples of such costs are wage, salaries, rents and taxes. Therefore explicit cost would be:

Thus, explicit for first year is $793,000.

Thus, explicit for first year is $793,000.

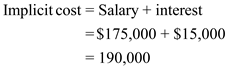

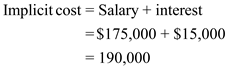

Implicit cost refers to the opportunity cost of choosing an option. In this case engineer left his job and put his personal saving of $100,000 that could have earned an interest of $15,000 a year.

Thus, implicit cost is $190,000.

Thus, implicit cost is $190,000.

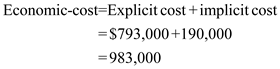

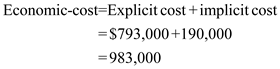

Total economic cost is total of explicit and implicit costs. It can be calculate in following manner:

Thus, economic cost is $983,000.

Thus, economic cost is $983,000.

b.

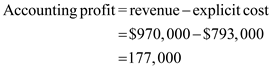

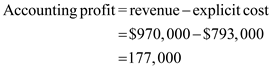

Accounting profit is the difference between total revenue and explicit cost. Here opportunity cost is not considered. It can be calculate in following manner:

Thus, accounting profit is $177,000.

Thus, accounting profit is $177,000.

c.

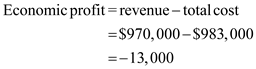

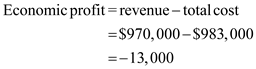

Economic profit is the difference between total revenue and total cost which includes both explicit and implicit costs. It can be calculate in following manner:

Thus, first year this business earned an economic loss of $13,000.

Thus, first year this business earned an economic loss of $13,000.

d.

The economic profit for SD Inc. is in negative which means an economic loss in the first year. But there is an accounting profit in the first year. Therefore, there could be an expected growth and increase in profits in the further years as the cost reduces and income increases. A judgment cannot be passed on the basis of one year profit and loss result.

a.

The following point explains various cost and income during his business:

Explicit cost refers to the cost of using outside resources. Examples of such costs are wage, salaries, rents and taxes. Therefore explicit cost would be:

Thus, explicit for first year is $793,000.

Thus, explicit for first year is $793,000.Implicit cost refers to the opportunity cost of choosing an option. In this case engineer left his job and put his personal saving of $100,000 that could have earned an interest of $15,000 a year.

Thus, implicit cost is $190,000.

Thus, implicit cost is $190,000.Total economic cost is total of explicit and implicit costs. It can be calculate in following manner:

Thus, economic cost is $983,000.

Thus, economic cost is $983,000.b.

Accounting profit is the difference between total revenue and explicit cost. Here opportunity cost is not considered. It can be calculate in following manner:

Thus, accounting profit is $177,000.

Thus, accounting profit is $177,000.c.

Economic profit is the difference between total revenue and total cost which includes both explicit and implicit costs. It can be calculate in following manner:

Thus, first year this business earned an economic loss of $13,000.

Thus, first year this business earned an economic loss of $13,000.d.

The economic profit for SD Inc. is in negative which means an economic loss in the first year. But there is an accounting profit in the first year. Therefore, there could be an expected growth and increase in profits in the further years as the cost reduces and income increases. A judgment cannot be passed on the basis of one year profit and loss result.

Managerial Economics 12th Edition by Christopher Thomas,Charles Maurice

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255