Real Estate Principles 3rd Edition by David Ling,Wayne Archer

Edition 3ISBN: 978-0073377322

Real Estate Principles 3rd Edition by David Ling,Wayne Archer

Edition 3ISBN: 978-0073377322 Exercise 6

Given the following situation and facts, complete a closing settlement statement similar to that shown in Exhibit 13-4.

On May 15, 2010, Eric Martin signed a contract to purchase a rental house for $195,000. Closing is to occur June 8, 2010, with the day of closing to be counted as a day of ownership by the buyer. Eric can assume the seller's first mortgage, which will have a balance of $149,000 on June 8. The seller, Reuben Smith, has agreed to take a second mortgage of $30,000 as part of the payment at closing. Eric paid an escrow deposit of $10,000 when he signed the purchase contract. Other pertinent facts include:

a. The monthly interest on the first mortgage is $745, which must be paid by the 20th day of the month.

b. Reuben paid a hazard insurance policy for the calendar year 2010. The premium was $850, and Eric has agreed to purchase Reuben's interest in the policy.

c. The monthly rental of $1,250 has been collected by Reuben for June.

d. The total amount of property tax for 2010is estimated to be $2,200. The tax will be paid by Eric at the end of the year.

e. The broker will pay the following expenses for Reuben and will be reimbursed at the closing:

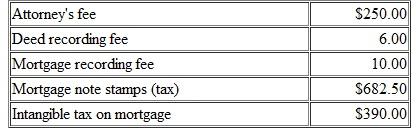

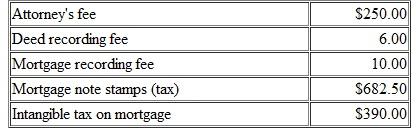

f. The broker will also pay the following expenses for Eric and will be reimbursed at the closing:

f. The broker will also pay the following expenses for Eric and will be reimbursed at the closing:

On May 15, 2010, Eric Martin signed a contract to purchase a rental house for $195,000. Closing is to occur June 8, 2010, with the day of closing to be counted as a day of ownership by the buyer. Eric can assume the seller's first mortgage, which will have a balance of $149,000 on June 8. The seller, Reuben Smith, has agreed to take a second mortgage of $30,000 as part of the payment at closing. Eric paid an escrow deposit of $10,000 when he signed the purchase contract. Other pertinent facts include:

a. The monthly interest on the first mortgage is $745, which must be paid by the 20th day of the month.

b. Reuben paid a hazard insurance policy for the calendar year 2010. The premium was $850, and Eric has agreed to purchase Reuben's interest in the policy.

c. The monthly rental of $1,250 has been collected by Reuben for June.

d. The total amount of property tax for 2010is estimated to be $2,200. The tax will be paid by Eric at the end of the year.

e. The broker will pay the following expenses for Reuben and will be reimbursed at the closing:

f. The broker will also pay the following expenses for Eric and will be reimbursed at the closing:

f. The broker will also pay the following expenses for Eric and will be reimbursed at the closing:

Explanation

Four items must be prorated between the ...

Real Estate Principles 3rd Edition by David Ling,Wayne Archer

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255