Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Edition 13ISBN: 978-1111971632

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Edition 13ISBN: 978-1111971632 Exercise 5

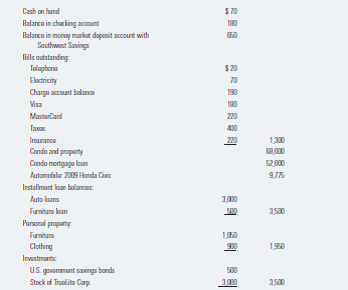

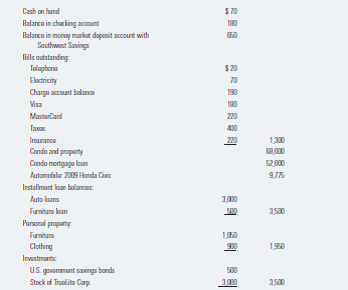

Use Worksheet 2.1. Teresa Blankenship's banker has asked her to submit a personal balance sheet as of June 30, 2015, in support of an application for a $6,000 home improvement loan. She comes to you for help in preparing it. So far, she has made the following list of her assets and liabilities as of June 30, 2015:

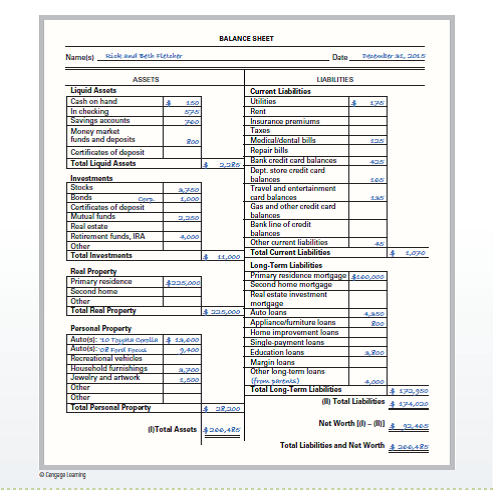

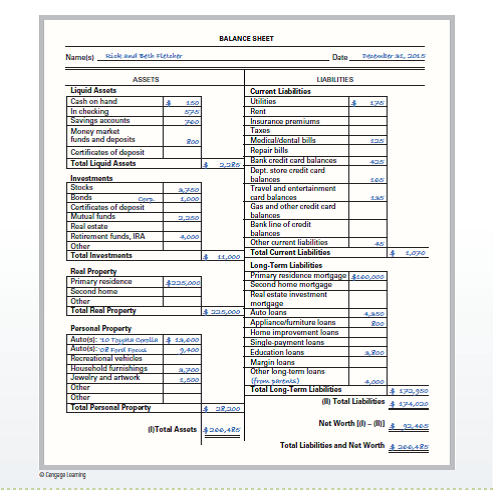

From the data given, prepare Teresa Blankenship's balance sheet, dated June 30, 2015 (follow the balance sheet form shown in Worksheet 2.1). Then evaluate her balance sheet relative to the following factors: (a) solvency, (b) liquidity, and (c) equity in her dominant asset.

REFERENCE :

From the data given, prepare Teresa Blankenship's balance sheet, dated June 30, 2015 (follow the balance sheet form shown in Worksheet 2.1). Then evaluate her balance sheet relative to the following factors: (a) solvency, (b) liquidity, and (c) equity in her dominant asset.

REFERENCE :

Explanation

Person TB wishes to take out a home impr...

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255