Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Edition 13ISBN: 978-1111971632

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Edition 13ISBN: 978-1111971632 Exercise 18

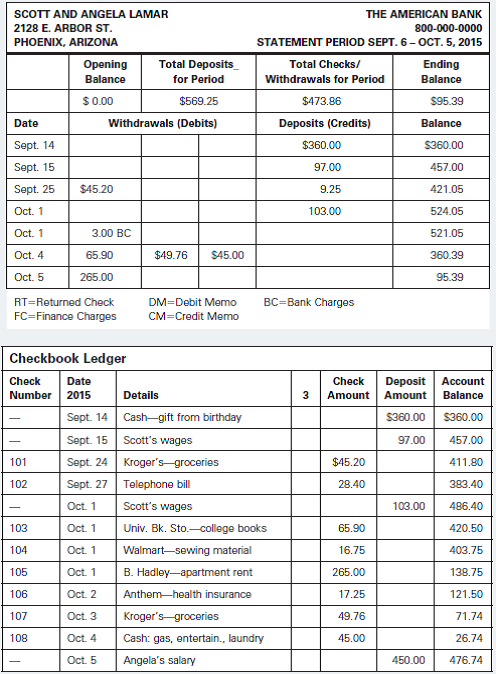

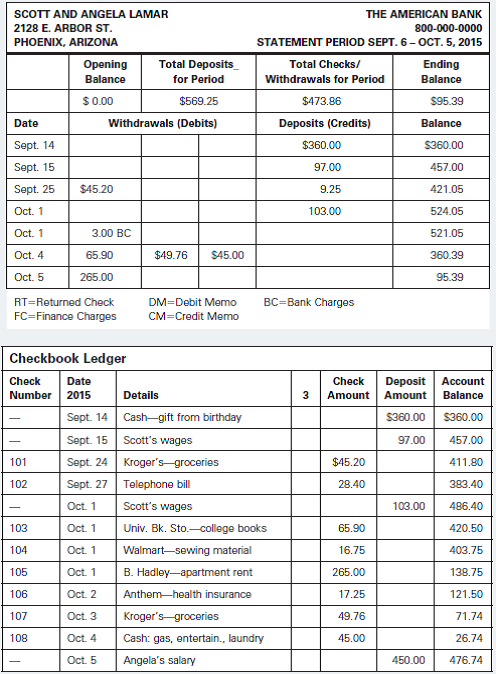

Scott and Angela Lamar are college students who opened their first joint checking account at the American Bank on September 14, 2015. They've just received their first bank statement for the period ending October 5, 2015. The statement and checkbook ledger are shown in the table on the next page.

Critical Thinking Questions

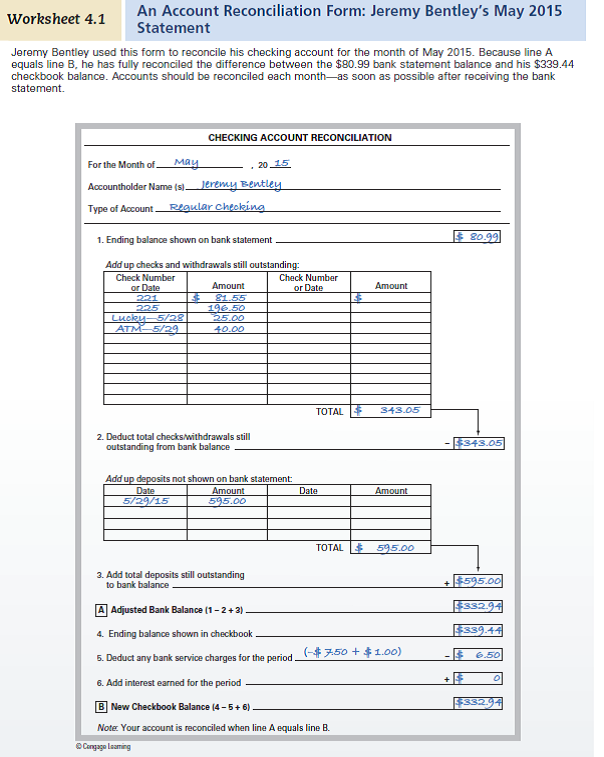

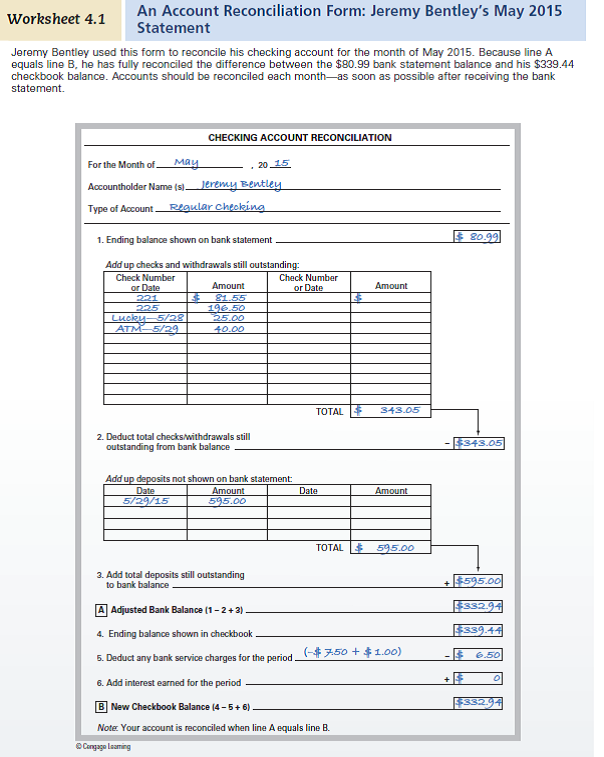

1. From this information, prepare a bank reconciliation for the Lamars as of October 5, 2015, using a form like the one in Worksheet 4.1.

2. Given your answer to Question 1, what, if any, adjustments will the Lamars need to make in their checkbook ledger Comment on the procedures used to reconcile their checking account and their findings.

3. If the Lamars earned interest on their idle balances because the account is a money market deposit account, what impact would this have on the reconciliation process Explain.

(Reference Worksheet 4.1)

Critical Thinking Questions

1. From this information, prepare a bank reconciliation for the Lamars as of October 5, 2015, using a form like the one in Worksheet 4.1.

2. Given your answer to Question 1, what, if any, adjustments will the Lamars need to make in their checkbook ledger Comment on the procedures used to reconcile their checking account and their findings.

3. If the Lamars earned interest on their idle balances because the account is a money market deposit account, what impact would this have on the reconciliation process Explain.

(Reference Worksheet 4.1)

Explanation

Persons SL and AL, married college stude...

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255