Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Edition 13ISBN: 978-1111971632

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Edition 13ISBN: 978-1111971632 Exercise 15

Bill and Audrey Harrison, a dual-income couple in their late 20s, want to replace their seven-year-old car, which has 90,000 miles on it and needs some expensive repairs. After reviewing their budget, the Harrisons conclude that they can afford auto payments of not more than $350 per month and a down payment of $2,000. They enthusiastically decide to visit a local dealer after reading its newspaper ad offering a closed-end lease on a new car for a monthly payment of $245. After visiting with the dealer, test-driving the car, and discussing the lease terms with the salesperson, they remain excited about leasing the car but decide to wait until the following day to finalize the deal. Later that day, the Harrisons begin to question their approach to the new car acquisition process and decide to reevaluate their decision carefully.

Critical Thinking Questions

1. What are some basic purchasing guidelines that the Harrisons should consider when choosing which new car to buy or lease How can they find the information they need

2. How would you advise the Harrisons to research the lease-versus-purchase decision before visiting the dealer What are the advantages and disadvantages of each alternative

3. Assume that the Harrisons can get the following terms on a lease or a bank loan for the car, which they could buy for $17,000. This amount includes tax, title, and license fees.

• Lease: 48 months, $245 monthly payment, 1 month's payment required as a security deposit, $350 end-of-lease charges; a residual value of $6,775 is the purchase option price at the end of the lease.

• Loan: $2,000 down payment, $15,000, 48-month loan at 5 percent interest requiring a monthly payment of $345.44; assume that the car's value at the end of 48 months will be the same as the residual value and that sales tax is 6 percent.

The Harrisons can currently earn interest of 3 percent annually on their savings. They expect to drive about the same number of miles per year as they do now.

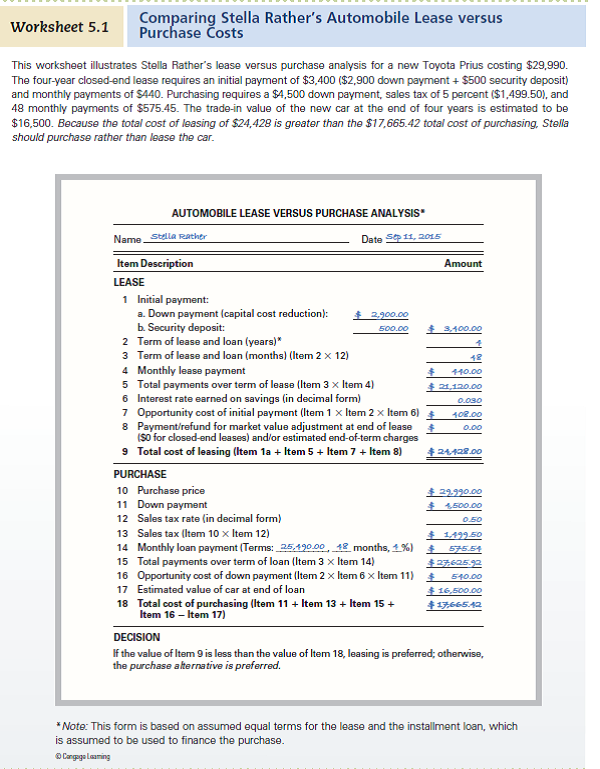

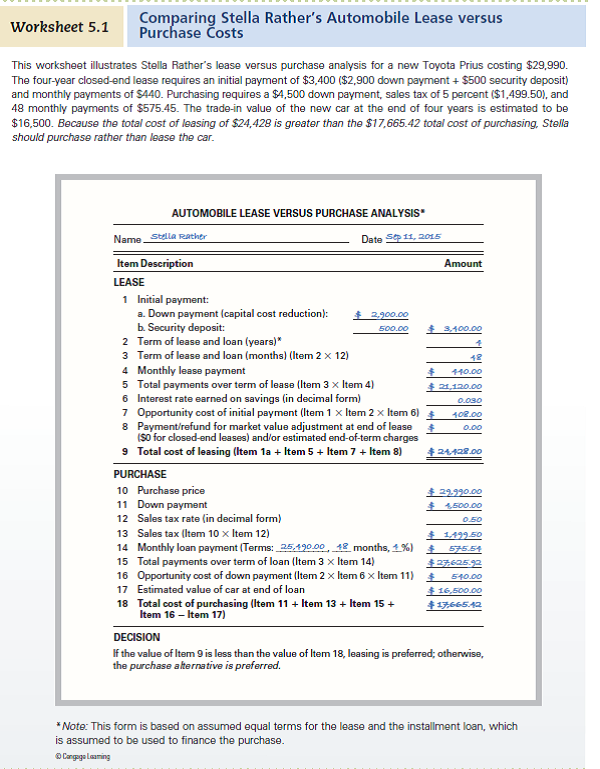

a. Use the format given in Worksheet 5.1 to determine which deal is best for the Harrisons.

b. What other costs and terms of the lease option might affect their decision

c. Based on the available information, should the Harrisons lease or purchase the car Why

(Reference Worksheet 5.1)

Critical Thinking Questions

1. What are some basic purchasing guidelines that the Harrisons should consider when choosing which new car to buy or lease How can they find the information they need

2. How would you advise the Harrisons to research the lease-versus-purchase decision before visiting the dealer What are the advantages and disadvantages of each alternative

3. Assume that the Harrisons can get the following terms on a lease or a bank loan for the car, which they could buy for $17,000. This amount includes tax, title, and license fees.

• Lease: 48 months, $245 monthly payment, 1 month's payment required as a security deposit, $350 end-of-lease charges; a residual value of $6,775 is the purchase option price at the end of the lease.

• Loan: $2,000 down payment, $15,000, 48-month loan at 5 percent interest requiring a monthly payment of $345.44; assume that the car's value at the end of 48 months will be the same as the residual value and that sales tax is 6 percent.

The Harrisons can currently earn interest of 3 percent annually on their savings. They expect to drive about the same number of miles per year as they do now.

a. Use the format given in Worksheet 5.1 to determine which deal is best for the Harrisons.

b. What other costs and terms of the lease option might affect their decision

c. Based on the available information, should the Harrisons lease or purchase the car Why

(Reference Worksheet 5.1)

Explanation

Persons BH and AH both work and earn an ...

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255