Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Edition 13ISBN: 978-1111971632

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Edition 13ISBN: 978-1111971632 Exercise 29

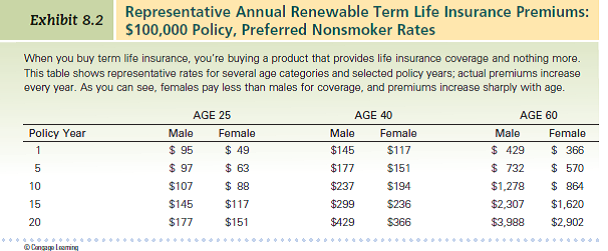

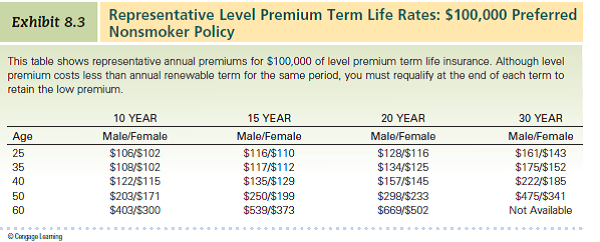

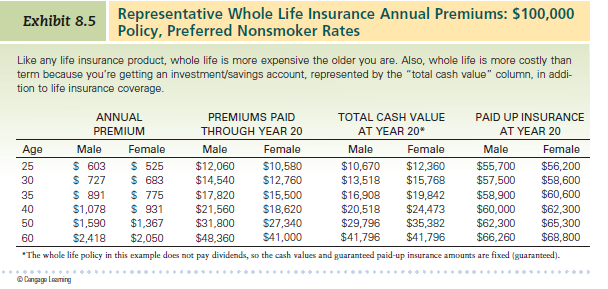

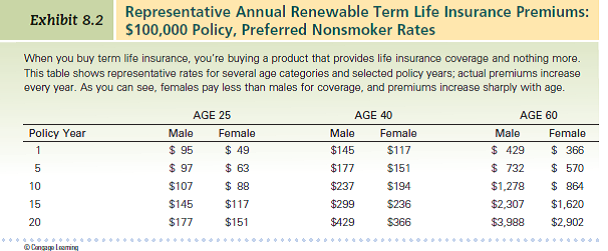

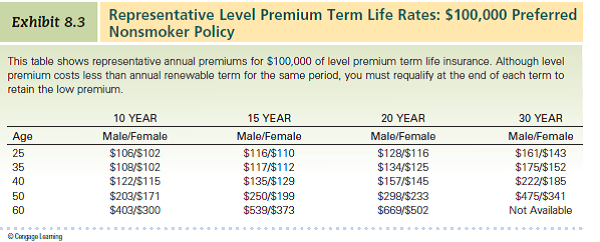

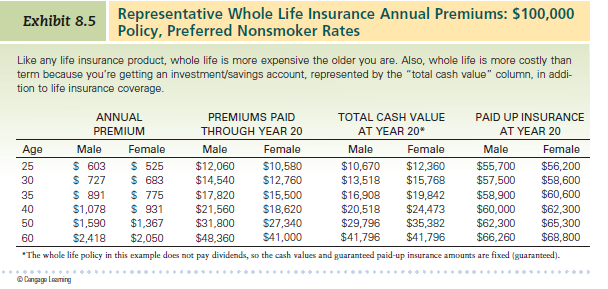

Using the premium schedules provided in Exhibits 8.2, 8.3, and 8.5, how much in annual premiums would a 25-year-old male have to pay for $100,000 of annual renewable term, level premium term, and whole life insurance (Assume a five-year term or period of coverage.) How much would a 25-year-old woman have to pay for the same coverage Consider a 40-year-old male (or female): Using annual premiums, compare the cost of 10 years of coverage under annual renewable and level premium term options and whole life insurance coverage. Relate the advantages and disadvantages of each policy type to their price differences.

(Reference Exhibits 8.2, 8.3, and 8.5)

(Reference Exhibits 8.2, 8.3, and 8.5)

Explanation

Investing amount for insurance is part o...

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255