Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Edition 13ISBN: 978-1111971632

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Edition 13ISBN: 978-1111971632 Exercise 11

Like many married couples, Gene and Stacey Uselton are trying their best to save for two important investment objectives: (1) an education fund to put their two children through college; and (2) a retirement nest egg for themselves. They want to have set aside $40,000 per child by the time each one starts college. Given that their children are now 10 and 12 years old, Gene and Stacey have 6 years remaining for one child and 8 for the other. As far as their retirement plans are concerned, the Useltons both hope to retire in 20 years, when they reach age 65. Both Gene and Stacey work, and together, they currently earn about $90,000 a year.

Six years ago, the Useltons started a college fund by investing $6,000 a year in bank CDs. That fund is now worth $45,000-enough to put one child through an in-state college. They also have $50,000 that they received from an inheritance invested in several mutual funds and another $20,000 in a taxsheltered retirement account. Gene and Stacey believe that they'll easily be able to continue putting away $6,000 a year for the next 20 years. In fact, Stacey thinks they'll be able to put away even more, particularly after the children are out of school. The Useltons are fairly conservative investors and feel they can probably earn about 6 percent on their money. (Ignore taxes for the purpose of this exercise.)

Critical Thinking Questions

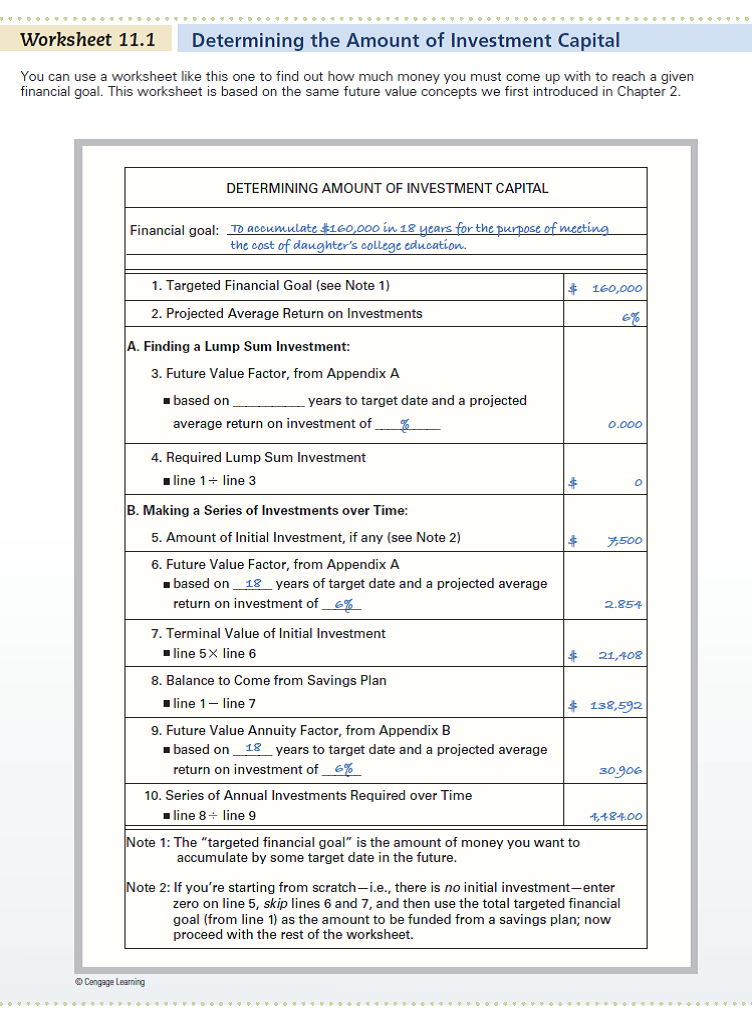

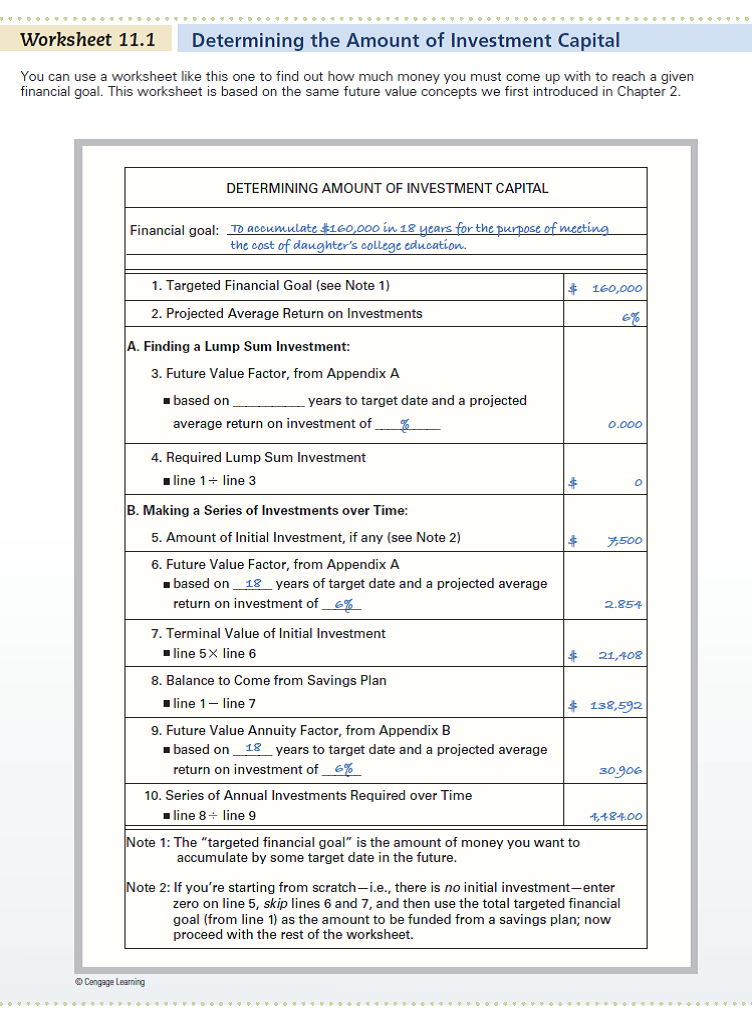

1. Use Worksheet 11.1 to determine whether the Useltons have enough money right now to meet their children's educational needs. That is, will the $45,000 they've accumulated so far be enough to put their children through school, given they can invest their money at 6 percent Remember, they want to have $40,000 set aside for each child by the time each one starts college.

2. Regarding their retirement nest egg, assume that no additions are made to either the $50,000 they now have in mutual funds or to the $20,000 in the retirement account. How much would these investments be worth in 20 years, given that they can earn 6 percent

3. Now, if the Useltons can invest $6,000 a year for the next 20 years and apply all of that to their retirement nest egg, how much would they be able to accumulate given their 6 percent rate of return

4. How do you think the Useltons are doing with regard to meeting their twin investment objectives Explain.

REFERENCE:

Six years ago, the Useltons started a college fund by investing $6,000 a year in bank CDs. That fund is now worth $45,000-enough to put one child through an in-state college. They also have $50,000 that they received from an inheritance invested in several mutual funds and another $20,000 in a taxsheltered retirement account. Gene and Stacey believe that they'll easily be able to continue putting away $6,000 a year for the next 20 years. In fact, Stacey thinks they'll be able to put away even more, particularly after the children are out of school. The Useltons are fairly conservative investors and feel they can probably earn about 6 percent on their money. (Ignore taxes for the purpose of this exercise.)

Critical Thinking Questions

1. Use Worksheet 11.1 to determine whether the Useltons have enough money right now to meet their children's educational needs. That is, will the $45,000 they've accumulated so far be enough to put their children through school, given they can invest their money at 6 percent Remember, they want to have $40,000 set aside for each child by the time each one starts college.

2. Regarding their retirement nest egg, assume that no additions are made to either the $50,000 they now have in mutual funds or to the $20,000 in the retirement account. How much would these investments be worth in 20 years, given that they can earn 6 percent

3. Now, if the Useltons can invest $6,000 a year for the next 20 years and apply all of that to their retirement nest egg, how much would they be able to accumulate given their 6 percent rate of return

4. How do you think the Useltons are doing with regard to meeting their twin investment objectives Explain.

REFERENCE:

Explanation

1)

The following table A1 shows the rew...

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255