Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Edition 13ISBN: 978-1111971632

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Edition 13ISBN: 978-1111971632 Exercise 14

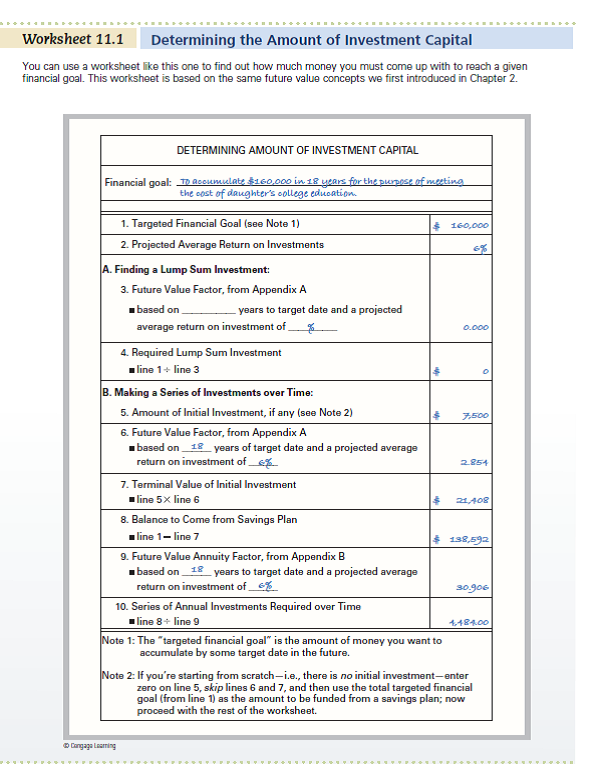

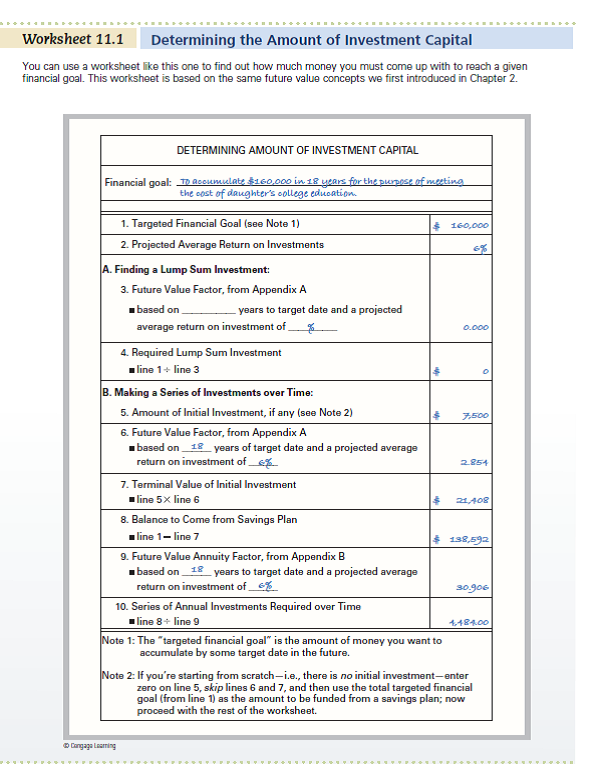

Use Worksheet 11.1 Linda Scales is a young career woman who's now employed as the managing editor of a well-known business journal. Although she thoroughly enjoys her job and the people she works with, what she would really like to do is open a bookstore of her own. She would like to open her store in about eight years and figures she'll need about $50,000 in capital to do so. Given that she thinks she can make about 10 percent on her money, use Worksheet 11.1 to answer the following questions.

a. How much would Linda have to invest today, in one lump sum, to end up with $50,000 in eight years

b. If she's starting from scratch, how much would she have to put away annually to accumulate the needed capital in eight years

c. How about if she already has $10,000 socked away; how much would she have to put away annually to accumulate the required capital in eight years

d. Given that Linda has an idea of how much she needs to save, briefly explain how she could use an investment plan to help reach her objective.

REFERENCE:

a. How much would Linda have to invest today, in one lump sum, to end up with $50,000 in eight years

b. If she's starting from scratch, how much would she have to put away annually to accumulate the needed capital in eight years

c. How about if she already has $10,000 socked away; how much would she have to put away annually to accumulate the required capital in eight years

d. Given that Linda has an idea of how much she needs to save, briefly explain how she could use an investment plan to help reach her objective.

REFERENCE:

Explanation

(a)

Use the worksheet shown below, and ...

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255