Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Edition 13ISBN: 978-1111971632

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Edition 13ISBN: 978-1111971632 Exercise 32

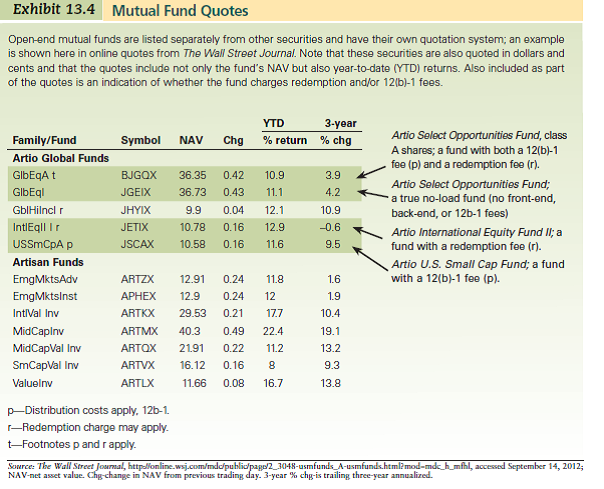

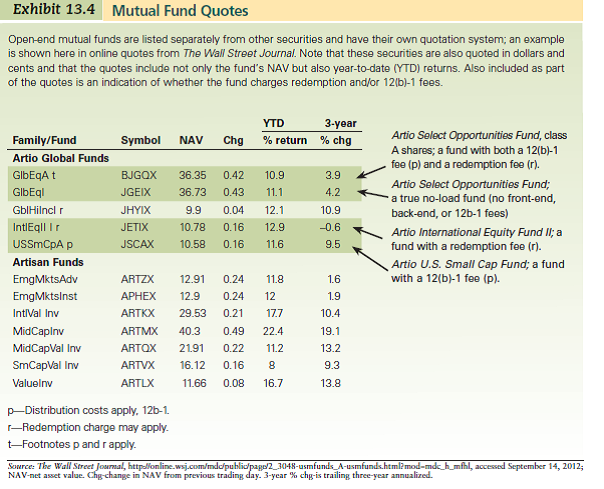

Using the mutual fund quotes in Exhibit 13.4, and assuming that you can buy these funds at their quoted NAVs, how much would you have to pay to buy each of the following funds

a. Artio Select Opportunities Fund, class A shares (GlbEqA )

b. Artio Select Opportunities Fund (GlbEqI)c. Artio International Equity Fund II (IntlEqII I)d. Artio U.S. Small Cap Fund (USSmCpA)According to the quotes, which of these four funds have 12(b)-1 fees Which have redemption fees Are any of them no-loads Which fund has the highest year-to-date return Which has the lowest

(Reference Exhibit 13.4)

a. Artio Select Opportunities Fund, class A shares (GlbEqA )

b. Artio Select Opportunities Fund (GlbEqI)c. Artio International Equity Fund II (IntlEqII I)d. Artio U.S. Small Cap Fund (USSmCpA)According to the quotes, which of these four funds have 12(b)-1 fees Which have redemption fees Are any of them no-loads Which fund has the highest year-to-date return Which has the lowest

(Reference Exhibit 13.4)

Explanation

a)

Fund ASOF class A shares have a NAV ...

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255