Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Edition 13ISBN: 978-1111971632

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Edition 13ISBN: 978-1111971632 Exercise 16

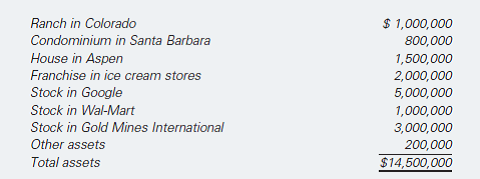

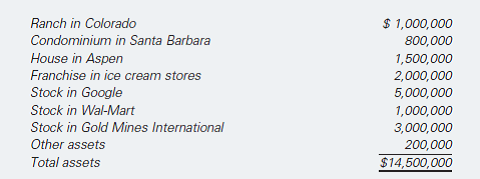

In the late 1970s, Latafat Tilki, from Turkey, migrated to the United States, where he is now a citizen. A man of many talents and deep foresight, he has built a large fleet of oceangoing oil tankers during his stay in the United States. Now a wealthy man in his 60s, he resides in Aspen, Colorado, with his second wife, Karen, age 50. They have two sons, one in junior high and one a high-school freshman. For some time, Latafat has considered preparing a will to ensure that his estate will be properly distributed when he dies. A survey of his estate reveals the following:

The house and the Gold Mines International shares are held in joint tenancy with his wife, but all other property is in his name alone. He desires that there be a separate fund of $1 million for his sons' education and that the balance of his estate be divided as follows: 40 percent to his sons, 40 percent to his wife, and 20 percent given to other relatives, friends, and charitable institutions. He has scheduled an appointment for drafting his will with his attorney and close friend, Gary Ingram. Latafat would like to appoint Gary, who is 70 years old, and Latafat's 40-year-old cousin, Ceylan Sadik (a CPA), as coexecutors. If one of them predeceases Latafat, he'd like Second National Bank to serve as co-executor.

Critical Thinking Questions

1. Does Latafat really need a will Explain why or why not. What would happen to his estate if he were to die without a will

2. Explain to Latafat the common features that need to be incorporated into a will.

3. Might the manner in which title is held thwart his estate planning desires What should be done to avoid problems

4. Is a living trust an appropriate part of his estate plan How would a living trust change the nature of Latafat's will

5. How does the age of his children complicate the estate plan What special provisions should he consider

6. What options are available to Latafat if he decides later to change or revoke the will Is it more difficult to change a living trust

7. What duties will Gary Ingram and Ceylan Sadik have to perform as co-executors of Latafat's estate If a trust is created, what should Latafat consider in his selection of a trustee or co-trustees Might Gary and Ceylan, serving together, be a good choice

The house and the Gold Mines International shares are held in joint tenancy with his wife, but all other property is in his name alone. He desires that there be a separate fund of $1 million for his sons' education and that the balance of his estate be divided as follows: 40 percent to his sons, 40 percent to his wife, and 20 percent given to other relatives, friends, and charitable institutions. He has scheduled an appointment for drafting his will with his attorney and close friend, Gary Ingram. Latafat would like to appoint Gary, who is 70 years old, and Latafat's 40-year-old cousin, Ceylan Sadik (a CPA), as coexecutors. If one of them predeceases Latafat, he'd like Second National Bank to serve as co-executor.

Critical Thinking Questions

1. Does Latafat really need a will Explain why or why not. What would happen to his estate if he were to die without a will

2. Explain to Latafat the common features that need to be incorporated into a will.

3. Might the manner in which title is held thwart his estate planning desires What should be done to avoid problems

4. Is a living trust an appropriate part of his estate plan How would a living trust change the nature of Latafat's will

5. How does the age of his children complicate the estate plan What special provisions should he consider

6. What options are available to Latafat if he decides later to change or revoke the will Is it more difficult to change a living trust

7. What duties will Gary Ingram and Ceylan Sadik have to perform as co-executors of Latafat's estate If a trust is created, what should Latafat consider in his selection of a trustee or co-trustees Might Gary and Ceylan, serving together, be a good choice

Explanation

(1)

Yes, Person L needs a will. Since h...

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255