Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Edition 13ISBN: 978-1111971632

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Edition 13ISBN: 978-1111971632 Exercise 22

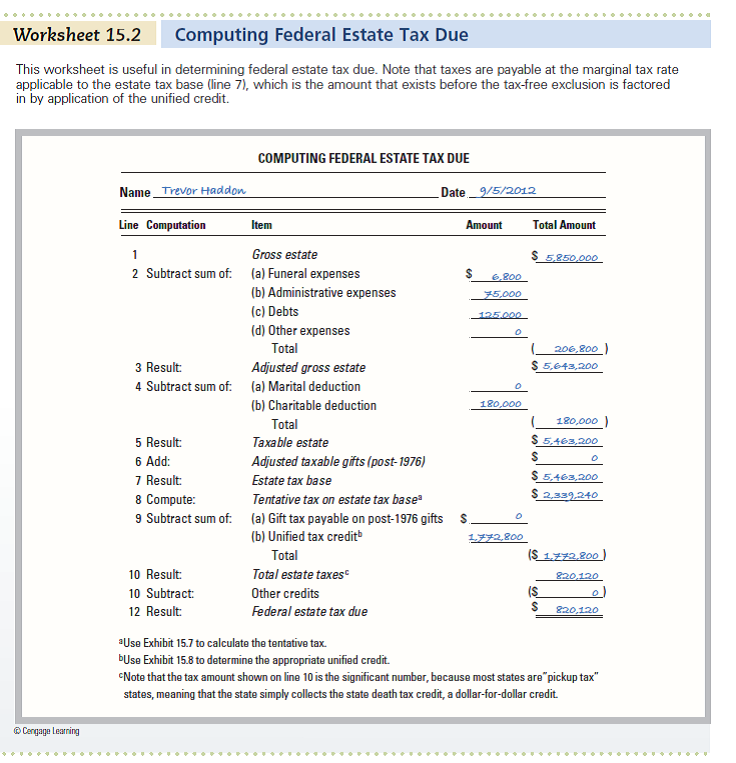

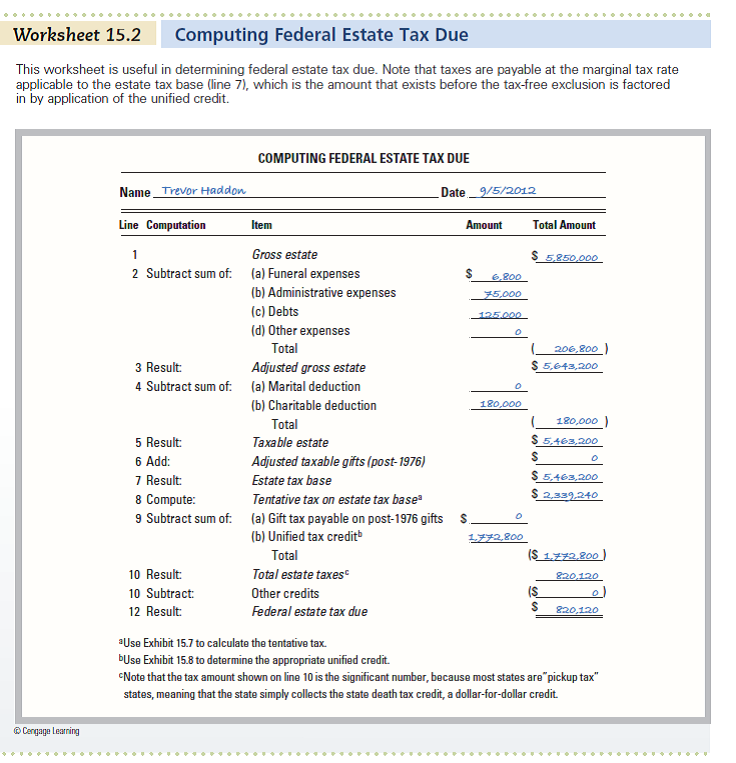

Robert Hancock, of Charlotte, North Carolina, was 65 when he retired in 2005. Alyssa, his wife of 40 years, passed away the next year. Her will left everything to Robert. Although Alyssa's estate was valued at $2,250,000, there was no estate tax due because of the 100 percent marital deduction. Their only child, Nathan, is married to Mary; they have four children, two in college and two in high school. In 2007, Robert made a gift of Apple stock worth $260,000 jointly to Nathan and Mary. Because of the two $13,000 annual exclusions and the unified credit, no gift taxes were due. When Robert died in 2012, his home was valued at $850,000, his vacation cabin on a lake was valued at $485,000, his investments in stocks and bonds at $1,890,000, and his pension funds at $645,000 (Nathan was named beneficiary). Robert also owned a life insurance policy that paid proceeds of $700,000 to Nathan. He left $60,000 to his church and $25,000 to his high school to start a scholarship fund in his wife's name. The rest of the estate was left to Nathan. Funeral costs were $15,000. Debts were $90,000 and miscellaneous expenses were $25,000. Attorney and accounting fees came to $36,000. Use Worksheet 15.2 to guide your calculations as you complete these exercises.

Critical Thinking Questions

1. Compute the value of Robert's probate estate.

2. Compute the value of Robert's gross estate.

3. Determine the total allowable deductions.

4. Calculate the estate tax base , taking into account the gifts given to Nathan and Mary (remember that the annual exclusions "adjust" the taxable gifts).

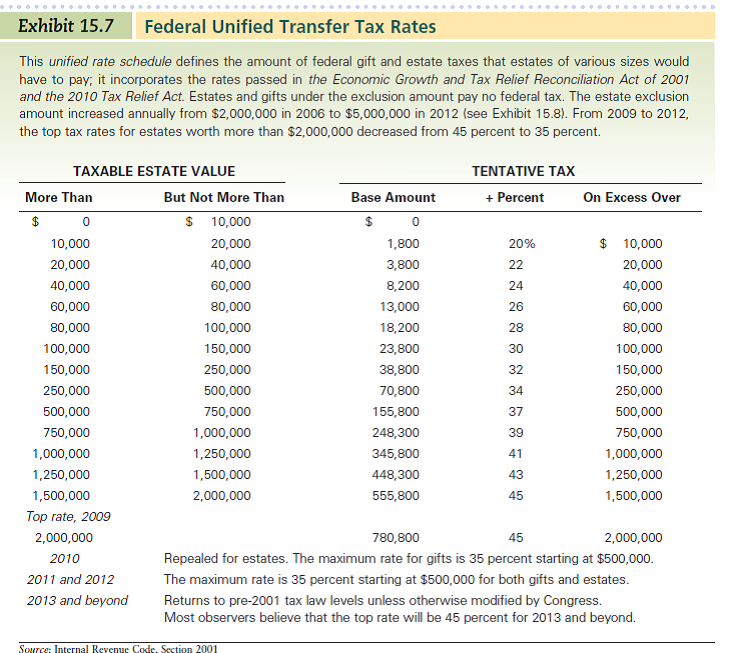

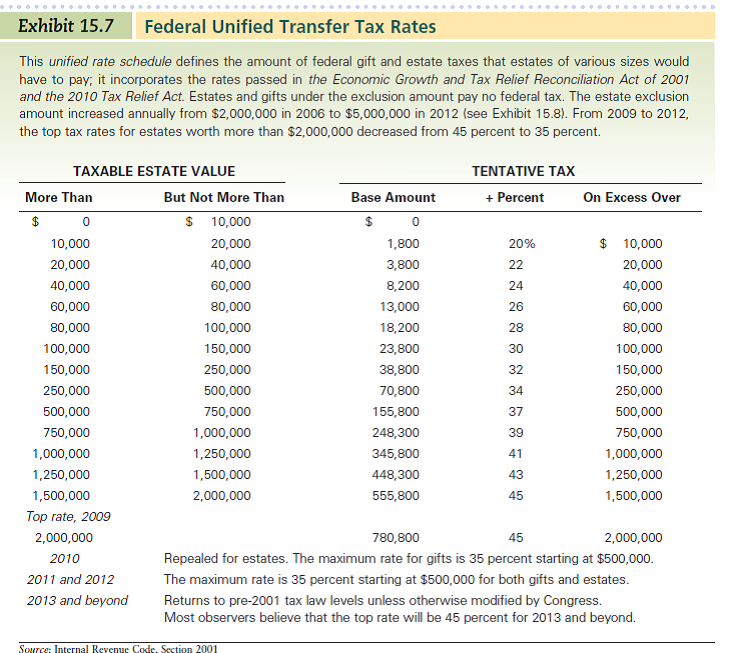

5. Use Exhibit 15.7 to determine the tentative tax on estate tax base.

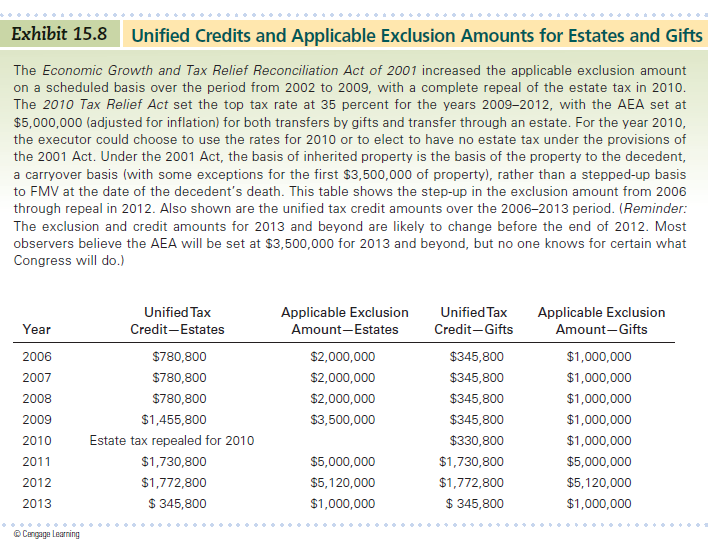

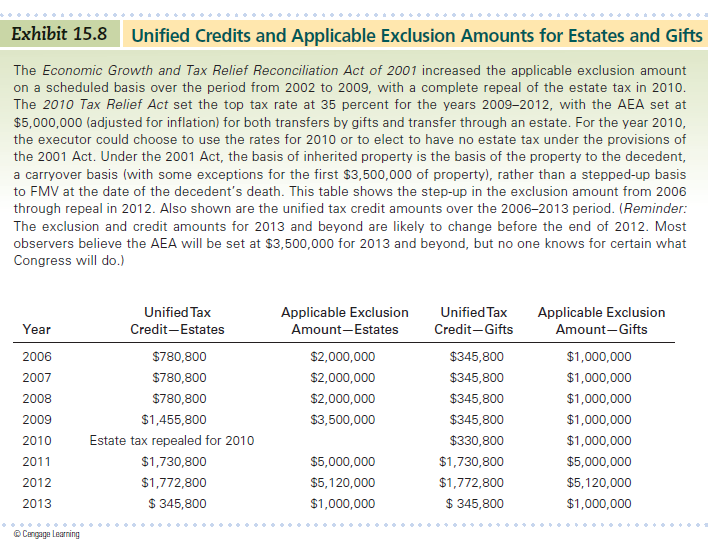

6. Subtract the appropriate unified tax credit (Exhibit 15.8) for 2012 from the tentative tax on estate tax base to arrive at the federal estate tax due.

REFERENCES:

Critical Thinking Questions

1. Compute the value of Robert's probate estate.

2. Compute the value of Robert's gross estate.

3. Determine the total allowable deductions.

4. Calculate the estate tax base , taking into account the gifts given to Nathan and Mary (remember that the annual exclusions "adjust" the taxable gifts).

5. Use Exhibit 15.7 to determine the tentative tax on estate tax base.

6. Subtract the appropriate unified tax credit (Exhibit 15.8) for 2012 from the tentative tax on estate tax base to arrive at the federal estate tax due.

REFERENCES:

Explanation

1)Proceeds from a life insurance policy ...

Personal Financial Planning 13th Edition by Lawrence Gitman,Michael Joehnk,Randy Billingsley

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255