Managerial Economics 7th Edition by Paul Keat ,Philip Young,Steve Erfle

Edition 7ISBN: 978-0133020267

Managerial Economics 7th Edition by Paul Keat ,Philip Young,Steve Erfle

Edition 7ISBN: 978-0133020267 Exercise 2

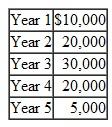

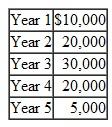

Your firm has an opportunity to make an investment of $50,000. Its cost of capital is 12 percent. It expects after-tax cash flows (including the tax shield from depreciation) for the next 5 years to be as follows:

a. Calculate the NPV.

a. Calculate the NPV.

b. Calculate the IRR (to the nearest percent).

c. Would you accept this project

a. Calculate the NPV.

a. Calculate the NPV.b. Calculate the IRR (to the nearest percent).

c. Would you accept this project

Explanation

Present value (PV) factors.

The ex...

Managerial Economics 7th Edition by Paul Keat ,Philip Young,Steve Erfle

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255