Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535 Exercise 60

Transactions; financial statements

On April 1, 2018, Maria Adams established Custom Realty. Maria completed the following transactions during the month of April:

A. Opened a business bank account with a deposit of $24,000 in exchange for common stock.

B. Paid rent on office and equipment for the month, $3,600.

C. Paid automobile expenses for month, $1,350, and miscellaneous expenses, $600.

D. Purchased supplies on account, $1,200.

E. Earned sales commissions, receiving cash, $19,800.

F. Paid creditor on account, $750.

G. Paid office salaries, $2,500.

H. Paid dividends, $3,500.

I. Determined that the cost of supplies on hand was $300; therefore, the cost of supplies used was $900.

Instructions

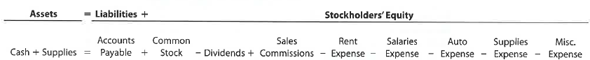

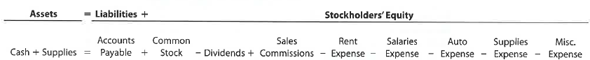

1. Indicate the effect of each transaction and the balances after each transaction, using the following tabular headings:

2. Prepare an income statement for April, a retained earnings statement for April, and a balance sheet as of April 30.

On April 1, 2018, Maria Adams established Custom Realty. Maria completed the following transactions during the month of April:

A. Opened a business bank account with a deposit of $24,000 in exchange for common stock.

B. Paid rent on office and equipment for the month, $3,600.

C. Paid automobile expenses for month, $1,350, and miscellaneous expenses, $600.

D. Purchased supplies on account, $1,200.

E. Earned sales commissions, receiving cash, $19,800.

F. Paid creditor on account, $750.

G. Paid office salaries, $2,500.

H. Paid dividends, $3,500.

I. Determined that the cost of supplies on hand was $300; therefore, the cost of supplies used was $900.

Instructions

1. Indicate the effect of each transaction and the balances after each transaction, using the following tabular headings:

2. Prepare an income statement for April, a retained earnings statement for April, and a balance sheet as of April 30.

Explanation

Financial Statements: The statements tha...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255