Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535 Exercise 24

Journal entries and trial balance

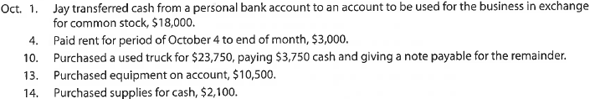

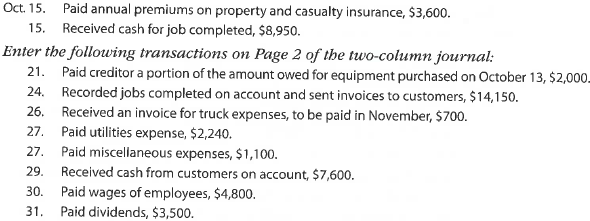

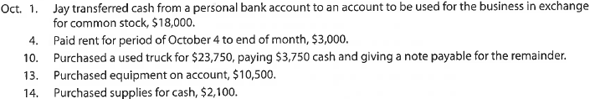

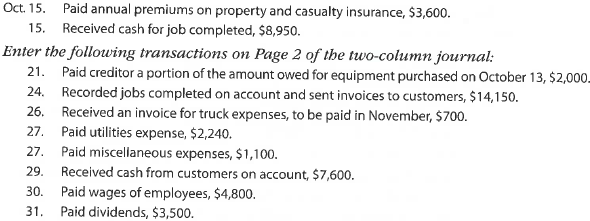

On October 1, 2018, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business:

Instructions

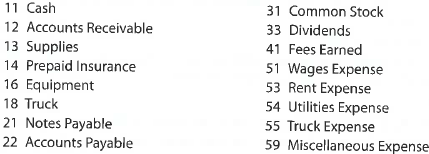

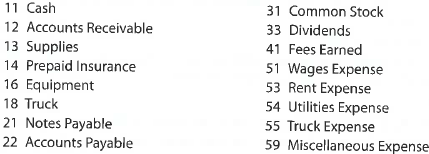

1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted.

2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted.

3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2018.

4. Determine the excess of revenues over expenses for October.

5. Can you think of any reason why the amount determined in (4) might not be the net income for October?

On October 1, 2018, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business:

Instructions

1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted.

2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted.

3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2018.

4. Determine the excess of revenues over expenses for October.

5. Can you think of any reason why the amount determined in (4) might not be the net income for October?

Explanation

In double entry accounting system, there...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255