Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535 Exercise 64

Adjusting entries

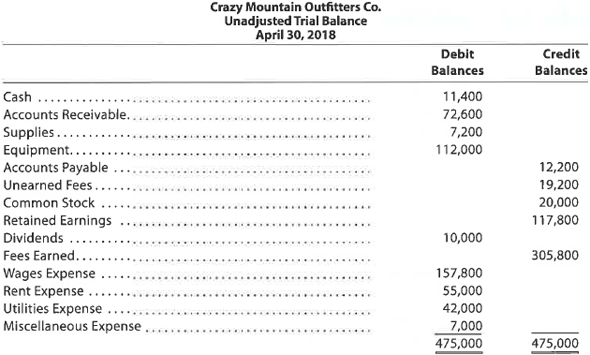

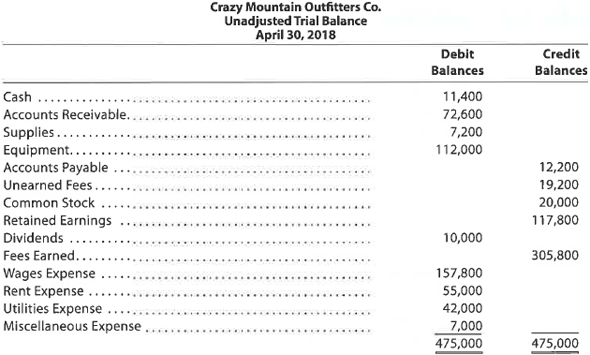

Crazy Mountain Outfitters Co., an outfitter store for fishing treks, prepared the following unadjusted trial balance at the end of its first year of operations:

For preparing the adjusting entries, the following data were assembled:

• Supplies on hand on April 30 were $1,380.

• Fees earned but unbilled on April 30 were $3,900.

• Depreciation of equipment was estimated to be $3,000 for the year.

• Unpaid wages accrued on April 30 were $2,475.

• The balance in unearned fees represented the April 1 receipt in advance for services to be provided. Only $14,140 of the services was provided between April 1 and April 30.

Instructions

1. Journalize the adjusting entries necessary on April 30, 2018.

2. Determine the revenues, expenses, and net income of Crazy Mountain Outfitters Co. before the adjusting entries.

3. Determine the revenues, expense, and net income of Crazy Mountain Outfitters Co. after the adjusting entries.

4. Determine the effect of the adjusting entries on Retained Earnings.

Crazy Mountain Outfitters Co., an outfitter store for fishing treks, prepared the following unadjusted trial balance at the end of its first year of operations:

For preparing the adjusting entries, the following data were assembled:

• Supplies on hand on April 30 were $1,380.

• Fees earned but unbilled on April 30 were $3,900.

• Depreciation of equipment was estimated to be $3,000 for the year.

• Unpaid wages accrued on April 30 were $2,475.

• The balance in unearned fees represented the April 1 receipt in advance for services to be provided. Only $14,140 of the services was provided between April 1 and April 30.

Instructions

1. Journalize the adjusting entries necessary on April 30, 2018.

2. Determine the revenues, expenses, and net income of Crazy Mountain Outfitters Co. before the adjusting entries.

3. Determine the revenues, expense, and net income of Crazy Mountain Outfitters Co. after the adjusting entries.

4. Determine the effect of the adjusting entries on Retained Earnings.

Explanation

There are two areas where such adjusted ...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255