Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535 Exercise 45

Financial statements and closing entries

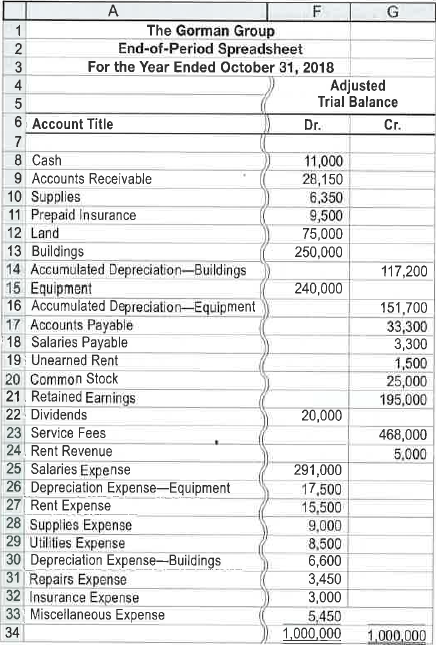

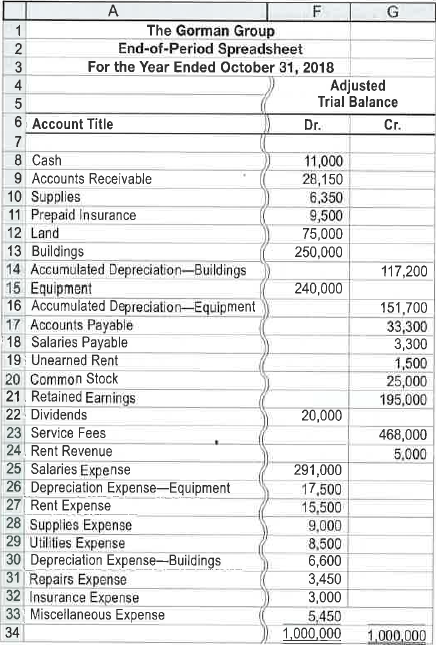

The Gorman Group is a financial planning services firm owned and operated by Nicole Gonnan. As of October 31, 2018, the end of the fiscal year, the accountant for The Gorman Group prepared an end-of-period spreadsheet, part of which follows:

Instructions

1. Prepare an income statement, a retained earnings statement, and a balance sheet.

2. Journalize the entries that were required to close the accounts at October 31.

3. If the balance of Retained Earnings had instead increased $115,000 after the closing entries were posted, and the dividends remained the same, what would have been the amount of net income or net loss?

The Gorman Group is a financial planning services firm owned and operated by Nicole Gonnan. As of October 31, 2018, the end of the fiscal year, the accountant for The Gorman Group prepared an end-of-period spreadsheet, part of which follows:

Instructions

1. Prepare an income statement, a retained earnings statement, and a balance sheet.

2. Journalize the entries that were required to close the accounts at October 31.

3. If the balance of Retained Earnings had instead increased $115,000 after the closing entries were posted, and the dividends remained the same, what would have been the amount of net income or net loss?

Explanation

Accounting Cycle

Using the spreadsheet,...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255