Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535 Exercise 18

Google and Microsoft: Current ratio

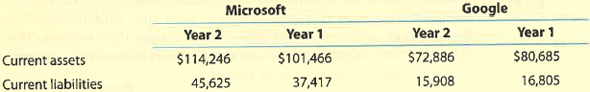

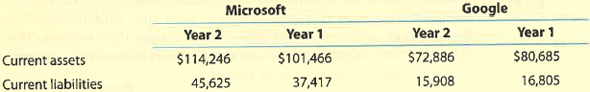

Google, Inc. and Microsoft Corporation design and distribute consumer and enterprise software, including overlaps in search, business productivity, and mobile operating systems. Google's primary source of revenue is from advertising, while Microsoft's is from software subscription and support fees. The following year-end data (in millions) were taken from recent balance sheets for both companies:

A. Compute the working capital for each company for both years.

B. Which company has the larger working capital at the end of Year 2?

C. Is working capital a good measure of relative liquidity in comparing the two companies? Explain.

D. Compute the current ratio for both companies. (Round to one decimal place.)

E. Which company has the larger relative liquidity based on the current ratio?

F. Based on your analysis, comment on the short-term debt-paying ability of these two companies.

Google, Inc. and Microsoft Corporation design and distribute consumer and enterprise software, including overlaps in search, business productivity, and mobile operating systems. Google's primary source of revenue is from advertising, while Microsoft's is from software subscription and support fees. The following year-end data (in millions) were taken from recent balance sheets for both companies:

A. Compute the working capital for each company for both years.

B. Which company has the larger working capital at the end of Year 2?

C. Is working capital a good measure of relative liquidity in comparing the two companies? Explain.

D. Compute the current ratio for both companies. (Round to one decimal place.)

E. Which company has the larger relative liquidity based on the current ratio?

F. Based on your analysis, comment on the short-term debt-paying ability of these two companies.

Explanation

Working capital is the difference betwee...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255