Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535 Exercise 40

Reversing entry

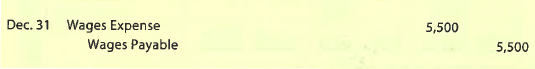

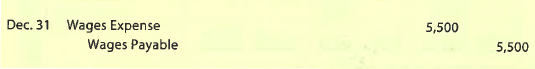

The following adjusting entry for accrued wages was recorded on December 31:

A. Journalize the reversing entry that would be made on January 1 of the next period.

B. Assume that the first paid period of the following year ends on January 6 and that wages of $61,375 were paid. Journalize the entry to record the payment of the January 6 wages.

C. Journalize the entry to record the payment of the January 6 wages assuming that a reversing entry was not made on January 1.

D. What is wages expense for the period January 1-6?

The following adjusting entry for accrued wages was recorded on December 31:

A. Journalize the reversing entry that would be made on January 1 of the next period.

B. Assume that the first paid period of the following year ends on January 6 and that wages of $61,375 were paid. Journalize the entry to record the payment of the January 6 wages.

C. Journalize the entry to record the payment of the January 6 wages assuming that a reversing entry was not made on January 1.

D. What is wages expense for the period January 1-6?

Explanation

Reversing Entry

Reversing entry is exac...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255