Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535 Exercise 28

Nike, lululemon, and Under Armour: Days' cash on hand

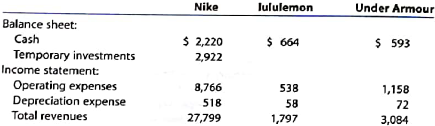

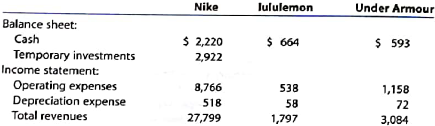

Three companies that compete in the athletic and activewear market segment are Nike, Inc., lululemon athletica inc., and Under Armour, Inc. Nike is the largest designer and seller of athletic footwear and apparel in the world. Lululemon designs and sells technical athletic apparel featuring yoga, fitness, and dance-inspired wear. Under Armour designs and sells athletic apparel featuring high-performance fabrics for men and women around the world. Selected financial information for a recent year follows (in millions):

A. How does the size of these companies, as represented by total revenues, compare to each other?

B. Compute the days' cash on hand for all three companies. (Round all calculations to one decimal place.)

C. Comment on the cash sufficiency for these three companies.

D. Which company appears to have the greatest cash liquidity?

E. Why is a ratio used to compare cash sufficiency across the three companies rather than just the companies' cash balances?

Three companies that compete in the athletic and activewear market segment are Nike, Inc., lululemon athletica inc., and Under Armour, Inc. Nike is the largest designer and seller of athletic footwear and apparel in the world. Lululemon designs and sells technical athletic apparel featuring yoga, fitness, and dance-inspired wear. Under Armour designs and sells athletic apparel featuring high-performance fabrics for men and women around the world. Selected financial information for a recent year follows (in millions):

A. How does the size of these companies, as represented by total revenues, compare to each other?

B. Compute the days' cash on hand for all three companies. (Round all calculations to one decimal place.)

C. Comment on the cash sufficiency for these three companies.

D. Which company appears to have the greatest cash liquidity?

E. Why is a ratio used to compare cash sufficiency across the three companies rather than just the companies' cash balances?

Explanation

Day's cash on hand is a tool to analyze ...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255