Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535 Exercise 52

Calculate payroll

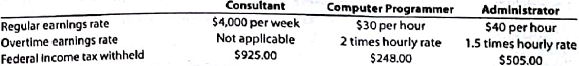

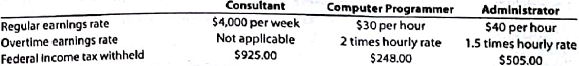

K. Mello Company has three employees a consultant, a computer programmer, and an administrator. The following payroll information is available for each employee:

For the current pay period, the computer programmer worked 44 hours and the administrator worked 48 hours. Assume that the social security tax rate was 6.0%, the Medicare tax rate was 1.5%.

Detemine the gross pay and the net pay for each of the three employees for the pay period.

K. Mello Company has three employees a consultant, a computer programmer, and an administrator. The following payroll information is available for each employee:

For the current pay period, the computer programmer worked 44 hours and the administrator worked 48 hours. Assume that the social security tax rate was 6.0%, the Medicare tax rate was 1.5%.

Detemine the gross pay and the net pay for each of the three employees for the pay period.

Explanation

Company KM is Consultancy Company which ...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255