Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 14ISBN: 978-1305653535 Exercise 49

Accrued product warranty

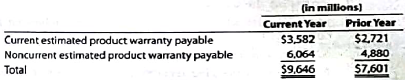

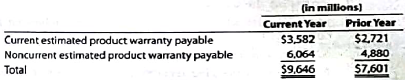

General Motors Company (GM) disclosed estimated product warranty payable for comparative years as follows:

Assume that GM's sales were $155,929 million in the current year and that the total paid on warranty claims during the current year was $4,326 million.

A. Why are short- and long-term estimated warranty liabilities separately disclosed?

B. Provide the journal entry for the current year product warranty expense.

C. What two conditions must be met in order for a product warranty liability to be reported in the financial statements?

General Motors Company (GM) disclosed estimated product warranty payable for comparative years as follows:

Assume that GM's sales were $155,929 million in the current year and that the total paid on warranty claims during the current year was $4,326 million.

A. Why are short- and long-term estimated warranty liabilities separately disclosed?

B. Provide the journal entry for the current year product warranty expense.

C. What two conditions must be met in order for a product warranty liability to be reported in the financial statements?

Explanation

Product policy:

When a business promise...

Corporate Financial Accounting 14th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255